5.18.25

UPenn Portfolio Update

This week, we’ll look at the recently updated portfolio for UPenn. As we highlighted in our 2023 and 2024 updates on UPenn’s portfolio, the school discloses a subset of manager investments in a tax filing for its employee retirement plan. While the dollar amounts are a small portion of what the investment office manages, we believe the manager roster is representative of the overall portfolio.

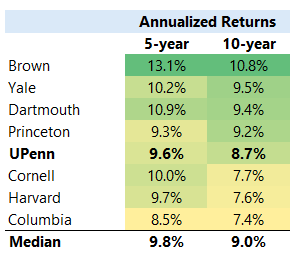

In terms of returns, UPenn falls in the middle of the Ivy League pack, annualizing at 9.6% and 8.7% over the last 5 and 10 years, respectively.

Source: University reports as of 6/30/24; OWL

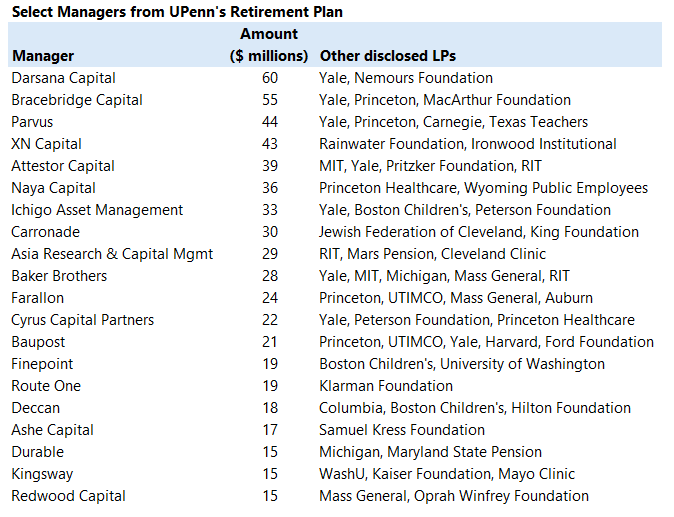

The table below includes a list of managers disclosed in UPenn’s retirement filings, and users can see the full list on UPenn’s profile . As we wrote about in 2023 , CIO Peter Ammon’s background at Yale likely plays a role in the heavy overlap in the two endowments’ portfolios:

Source: UPenn public filings as of 6/30/24; OWL; Amounts represent allocations for pension plan only

Other disclosed managers for UPenn include CPMG , Ribbit , Hillhouse , Five Point Energy , Stockbridge , Thrive Capital , and Y Combinator Management.

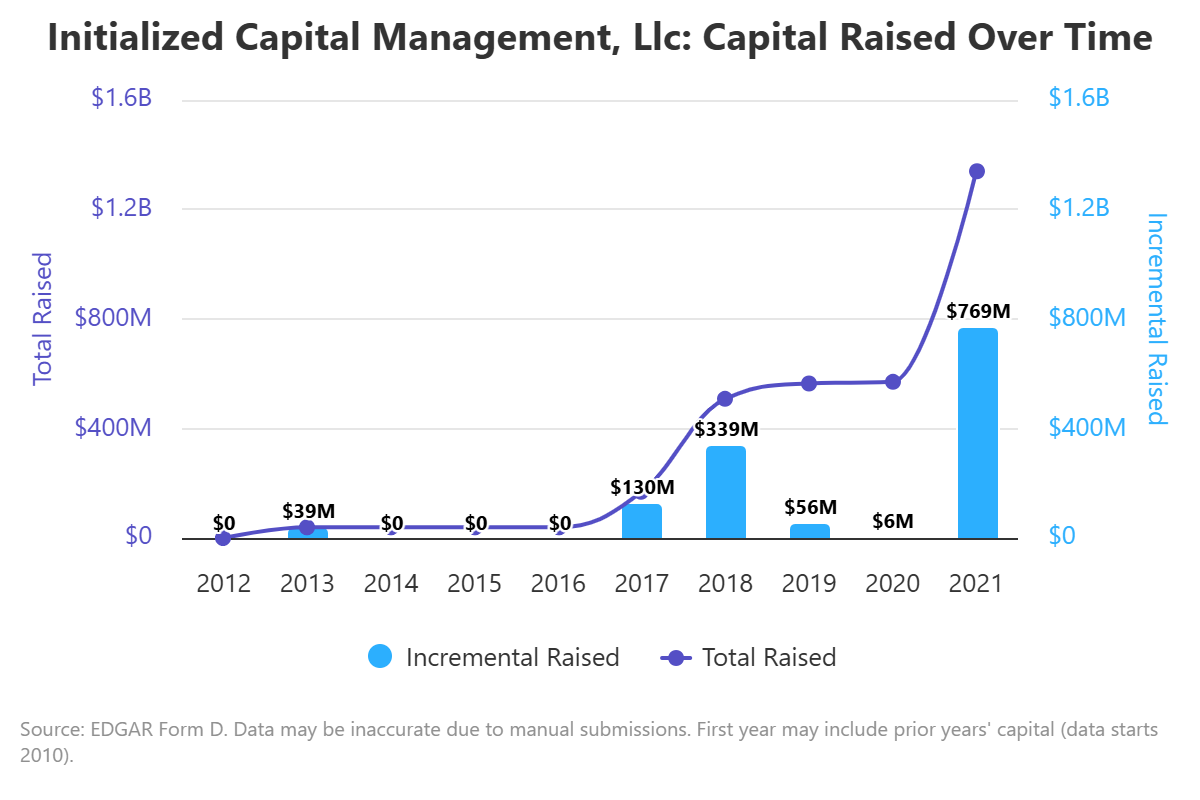

Initialized Capital Management , a VC founded in 2011 by Alexis Ohanian and Garry Tan , has other notable LPs, including MIT , Duke , Harvard , and UTIMCO . Ohanian went on to lead Reddit and is currently the founder of Seven Seven Six , a $1 billion early-stage VC fund. Tan is now the President and CEO of Y Combinator , which manages $16 billion. As a reminder, our users can track former employees for thousands of managers in OWL, helping with reference checks and with identifying spinouts or interesting new funds.

Brett Gibson is now the managing partner at Initialized, after co-founding several companies and working for Y Combinator. Initialized focuses on early-stage companies and has invested in 27 unicorns to date, including Coinbase, Instacart, Opendoor, and Flexport.

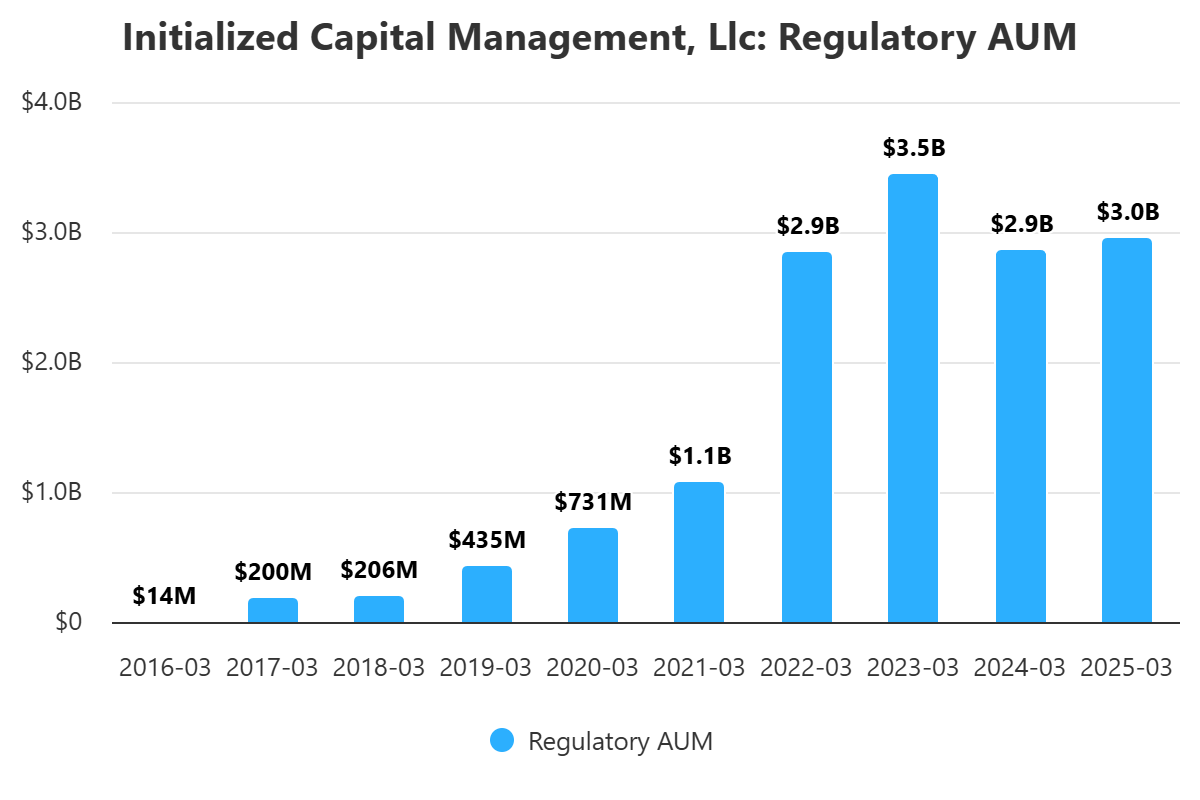

Initialized AUM has grown substantially over the past few years. 2021 was a big fundraising year for the firm, and since then, they have doubled the number of funds and SPVs in their portfolio.

For our users, OWL has the fundraising history for thousands of managers on our platform, along with fund-level details for AUM and capital raised.

Recent Buys/Sells

New Oriental – Discerene initiated a $77M position during Q1 after closing out its position in late 2023. It’s currently the fund’s third largest position after Alibaba and JD.com.

Cloudflare – SW Investment Management exited its position during Q1

Bloom Energy – Tree Line initiated a position in the fuel cell energy company during Q1

Postal Savings Bank of China – Himalaya closed its position on 5/8

Edgewise Therapeutics – Orbimed reduced its position in the biopharmaceutical company by 49% on 5/12; the fund still owns 14.5% of the company.

Vonovia – Elliott reduced its short position by 14% on 5/9. Elliott has been reducing its short position since January 2025 and is now short 0.8% of the German real estate company.

Other News/Events

Chris Hohn (TCI) interviewed on Nicolai Tangen's Podcast

MIT, Yale Face Endowment Tax Hike While Notre Dame Scores Break

Columbia's $15 Billion Endowment Risks Big Hit on GOP Tax Tweak

A Buffett-Backed College Faces GOP Tax Threats After Investment Success

Bola Olusanya Named Vice President and Chief Investment Officer of the MacArthur Foundation

University of Utah to ramp up alts, with OCIO help ‘here in our own backyard’

VMG Partners Announces the $1.0 Billion Close of Consumer Fund VI

How a $50M loan to CoreWeave became Magnetar Capital’s boldest bet

Josh Kushner’s Thrive Capital Gains $522 Million From Carvana Trade

RA Capital's biotech incubator lays off staffers

Capital Allocators Hiring Head of Content

Please reach out anytime with questions, comments, suggestions, or ideas!

-The OWL Team

About Old Well Labs (OWL)

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Please feel free to selectively share these updates with high-quality allocators who might be interested in learning more about the system.

Reach out to learn how OWL can help you find, monitor, and connect with fund managers globally