5.10.24

Dear OWL Users,

This week, we’ll look at recently disclosed updates for UPenn’s manager roster. OWL users can see full details on UPenn’s profile page here.

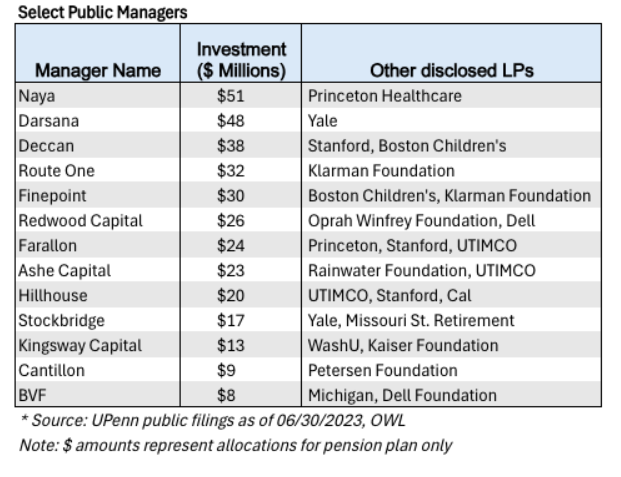

As we first highlighted in our initial report on UPenn last year, the school discloses manager investments in a tax filing for its employee retirement plan. While the dollar amounts are a small portion of what the investment office manages, we believe the manager roster is representative of the overall portfolio.

Peter Ammon has been the CIO at UPenn since 2013, following stints in the investment offices at both Yale and Princeton. UPenn has generated annualized returns of 9.7% over the past ten years, ranking in the top 20 of the ~200 endowments we track in OWL. OWL users can see our full table of endowment returns here.

UPenn’s Public Managers

Other disclosed public managers include Ichigo , Amansa , Perry Creek , Baker Brothers , Durable , and XN Capital . OWL users can see full details for over 150 disclosed manager relationships across asset classes on UPenn’s portfolio page in OWL.

One of UPenn’s most successful public managers is Stockbridge Partners. Founded in 2007, Stockbridge is the public equities unit of Berkshire Partners , a Boston-based private equity firm known for backing companies like Aritzia and National Vision. Run by Rob Small , Stockbridge enjoys the unique benefit of "deep and frequent collaboration" with the Berkshire private equity team, drawing on the firm’s collective intellectual capital and relationships to inform their investment decisions. Stockbridge also counts Yale, University of California, and the Heinz Foundation as other notable LPs, which users can see in OWL.

Stockbridge’s stated goal is to deliver strong absolute returns by concentrating the portfolio in high-quality businesses. Stockbridge’s disclosed portfolio is indeed highly concentrated, with the top 10 positions accounting for 90% of public AUM.

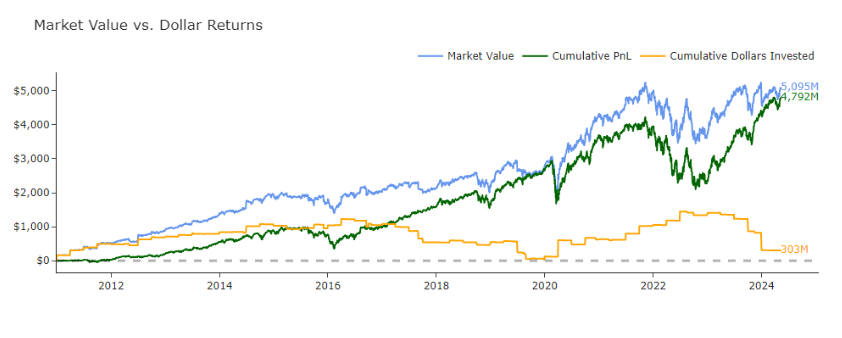

Stockbridge first disclosed positions in early 2011, and OWL estimates those holdings have compounded at almost 16% through this week. The firm’s dollar-weighted returns have also been quite impressive - OWL estimates Stockbridge has generated $4.8 billion of profits on only $300 million of cumulative dollars invested. TransDigm , Stockbridge’s largest position, accounts for 27% of the disclosed portfolio today and has generated nearly $2 billion of those profits since 2010

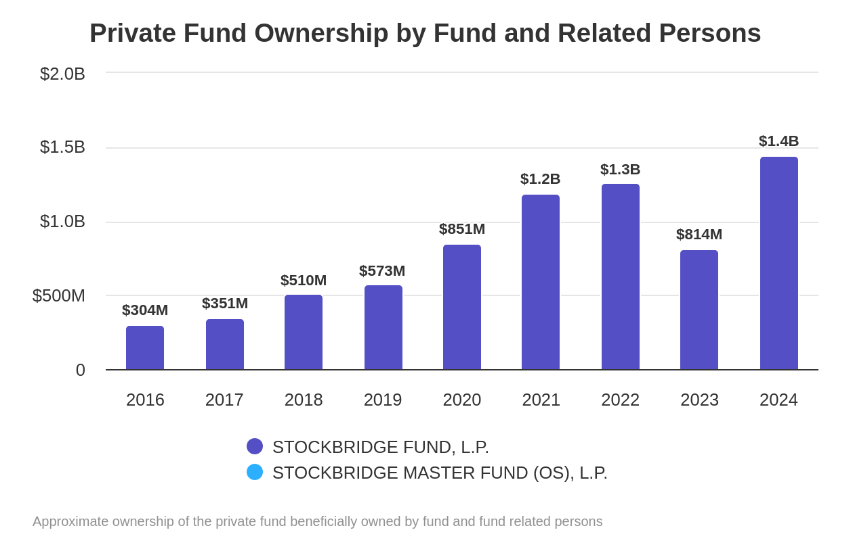

According to disclosures that can now be tracked in OWL, the team’s internal capital invested in its fund has also grown over time:

Product Update – New ADV Data

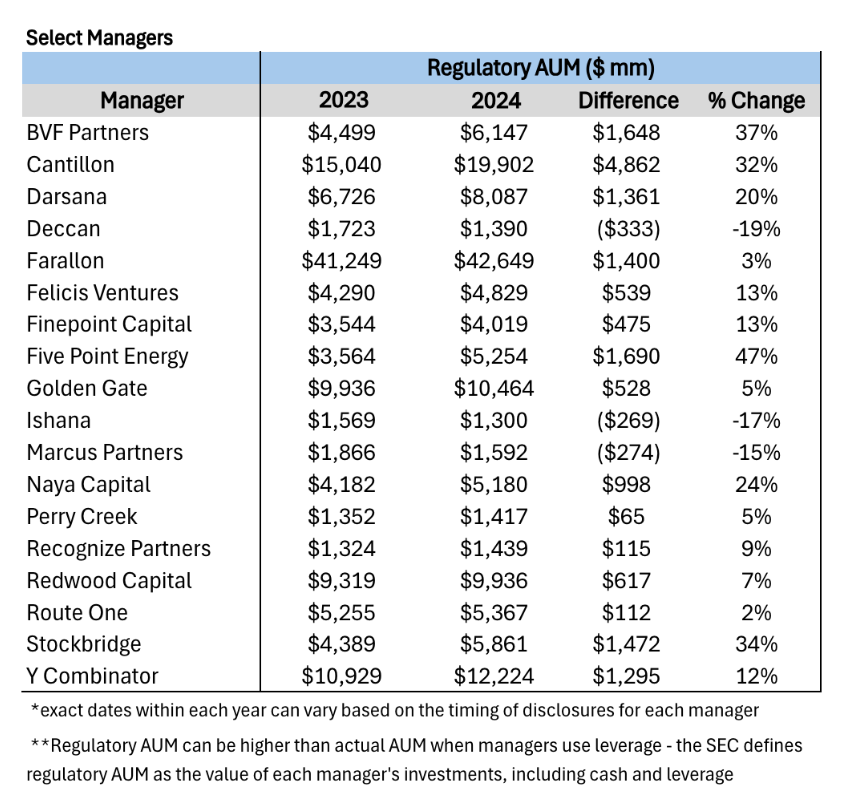

We now have 2024 form ADV updates for nearly all of the 7,500+ managers in OWL, with updated data for AUM levels, funds managed, internal capital invested, firm ownership levels, and much more!

We’re building additional displays to monitor changes in this data over time, and for the recent update, we’ve also built automated ADV updates that can be sent to OWL users. For each manager a user tracks in OWL's “My Portfolio” section, we can generate a report of key year-over-year changes disclosed in the most recent ADV. Please reach out if you’d like a sample.

One of the many reports that can be generated is below, in this case highlighting changes in regulatory AUM levels for a selection of UPenn’s managers:

Recent Buys / Sells

Biolife Solutions – Casdin Capital bought an additional 300 thousand shares on April 30th, bringing their ownership stake in the company north of 20%.

Citi Trends – Pleasant Lake Partners bought an additional ~100 thousand shares from April 26th through May 3rd, bringing their ownership stake in the company to 23%.

Willdan Group – Forager Capital sold nearly 300 thousand shares in their largest position on May 3rd.

Eyepoint Pharmaceuticals – Cormorant bought an additional 850 thousand shares on May 6th after the company said its experimental retinal disease treatment had failed to meet the primary goal in a clinical trial.

Please reach out anytime with questions, comments, suggestions, or ideas!

-The OWL Team

About Old Well Labs (OWL)

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Please feel free to selectively share these updates with high-quality allocators who might be interested in learning more about the system.

Reach out to learn how OWL can help you find, monitor, and connect with fund managers globally