12.6.24

Dear OWL Users,

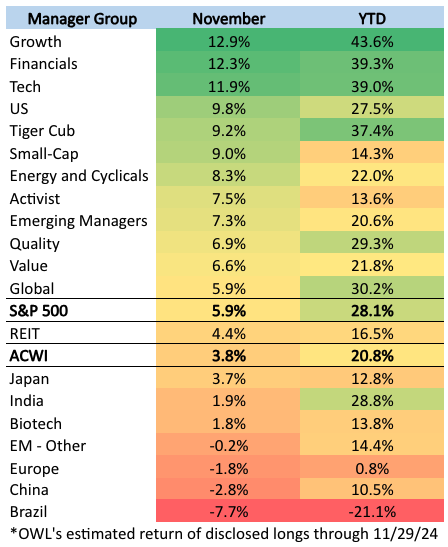

For the second month in a row, Growth, Financials, and Tech-focused managers saw their disclosed longs perform the best of any OWL group. International managers continued to underperform, with Brazil, China, and Europe-focused funds faring the worst.

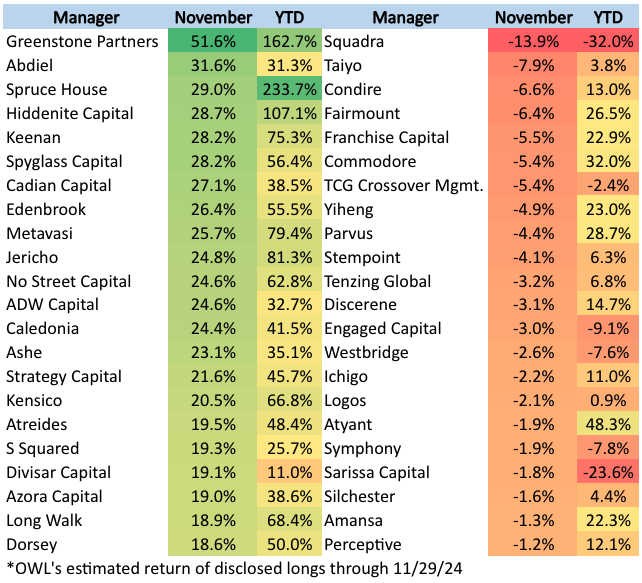

A selection of managers with the best and worst performing disclosed long positions is below. As we noted in our review of 3Q 13F highlights , one of the biggest drivers of performance in November was exposure to AppLovin. Seven of the ten best-performing managers highlighted below held AppLovin as their top disclosed position, capturing a nearly 100% increase in the stock price during November. These include Greenstone , Spruce House , Hiddenite , Keenan , Spyglass , Metavasi , and Jericho . Squadra had several of its top disclosed holdings sell off ~20% or more during November, including Ultrapar Participos and XP.

One manager that missed out on the big gains in November was Hillhouse , who was profiled in a WSJ article over the weekend.

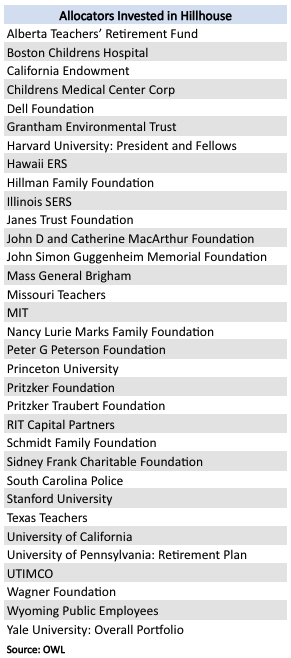

The article noted that Hillhouse’s name did not appear in one particular section of a Yale disclosure for 06/30/2023, implying that perhaps the school had redeemed. Using data in OWL from various disclosures, we can confirm that Yale was still invested in Hillhouse as of 6/30/2023. While the position on that date was worth over $500 million, it did reflect a meaningful decrease from a year prior.

The article also notes that Hillhouse executives said, “they expect to have fewer American endowments as clients going forward.” Looking through the 40+ allocators mapped to Hillhouse in OWL, we can see that several allocators, including UTIMCO, Illinois SERS, MIT, and the Pritzker Foundation, meaningfully reduced their exposure to Hillhouse from the prior year.

The table below is a selection of the allocators and their disclosed investments in Hillhouse. OWL users can see the full list of allocators, including how their investments have trended over time, here.

Recent Buys / Sells:

Kanto Denka Kogyo – Effisimo disclosed additional purchases in the Japanese chemical company on November 25th, bringing their stake to over 19%.

Gildan Activewear – Browning West disclosed selling nearly $130 million of their position in the clothing company between November 1st and December 3rd.

BeiGene – Hillhouse disclosed the sale of roughly $275 million of their position in the oncology company on December 2nd.

Daktronics – Alta Fox added to their stake in the digital display company on November 25th, bringing their ownership stake to over 4% of the company.

Universal Technical Institute – Coliseum sold over 25% of their position in the for- profit education company on December 2nd, reducing their ownership stake to 12.7%.

GMM Pfaudler – Amansa disclosed an increased stake in the Indian industrial company on November 27th, bringing their ownership to 5.8% of shares outstanding.

Other News & Events

Blackrock acquired private credit manager HPS for $12 billion

RTW Probed by SEC Over Role in Masimo Proxy Fight

Article on Baupost & Elliott investments in Energy PE continuation funds

Podcast on the role of AI in investment management featuring Dave Morehead, Baylor CIO

Podcast with John Hempton of Bronte Capital on investing in uncertain times

Institutional Investor article on expected growth in OCIOs

NYC Pension announced that 13% of its assets are invested with minority- and women-owned funds

The University of Florida Foundation returned 7.2% in FY24

Investure is hiring an Associate for Manager Selection (Public Portfolio)

University of Minnesota is hiring an Investment Director

Unum Group is hiring a CIO

Partners Capital is hiring an Investment Principal

Please reach out anytime with questions, comments, suggestions, or ideas!

-The OWL Team

About Old Well Labs (OWL)

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Please feel free to selectively share these updates with high-quality allocators who might be interested in learning more about the system.

Reach out to learn how OWL can help you find, monitor, and connect with fund managers globally