11.22.2024

Dear OWL Users,

Today, we look at the activity disclosed in last week’s quarterly 13F release, including lots of buying in the power space. As a note, all links in the 13F section go to the manager profiles in OWL.

Buying Power

One noticeable trend in the latest filings is significant buying in a handful of power and electrical companies. Four examples that stand out:

Talen Energy

The company uplisted its stock from the OTC market to the Nasdaq during Q3 and is now one of the most heavily owned hedge fund stocks in OWL.

Managers with large positions: Rubric Capital , Engle Capital , Two Seas Capital , Atalan Capital , Sachem Head , Philosophy Capital , Merewether , Bornite Capital , and Maple Rock Capital.

Vistra Corp

Managers buying in Q3: Valiant Capital , Segra Capital , Castle Hook Partners , Forest Avenue Capital , Appaloosa , Avala Global , Maple Rock Capital , Blue Grotto Capital , and Rubric Capital.

Other managers with positions: Third Point , Lone Pine , and Merewether.

GE Vernova

Managers buying in Q3: Castle Hook Partners , Rivermont Capital , Valiant Capital , Avala Global , Coatue , and Hillhouse.

Other managers with positions: Surgocap , Electron Capital , Merewether , Steadfast , Slate Path , Lone Pine , and Kinetic Partners.

Constellation Energy

Managers buying in Q3: 59 North , Rivermont Capital , Forest Avenue Capital , Castle Hook Partners , Coatue , Steadfast , Lone Pine , Southpoint , Nishkama Capital , and Night Owl Capital.

Other managers with positions: Electron Capital and Valiant Capital.

Lovin AppLovin

Software company AppLovin is one of the best-performing stocks of 2024, up almost 700%, including more than 150% since 09/30 holdings were disclosed. Dorsey Asset Management was one of the largest buyers during Q3, establishing a new position that is now the fund’s largest disclosed holding.

Kensico was also a large buyer of the stock during Q3, while Panview Capital , Greenstone Partners , Hiddenite Capital , Keenan Capital , Jericho Capital , No Street Capital , Blue Grotto Capital , Kinetic Partners , and Metavasi Capital also held large positions as of 09/30.

Spruce House has also been a large holder with a stake of over 1% in the company. OWL estimates that Spruce House is now above its prior high watermark, driven by AppLovin and Carvana, despite its disclosed positions dropping over 80% from the preceding high:

Spruce House – Return of Disclosed Positions:

Kinetic Partners

One manager involved in the power space and AppLovin is Kinetic Partners , launched in 2021 by Christopher Golden (ex-Blue Ridge and Darsana). Kinetic manages $1.6 billion and is one of a handful of hedge funds in which the Tiger Foundation is invested (OWL users can see the foundation’s entire portfolio here ).

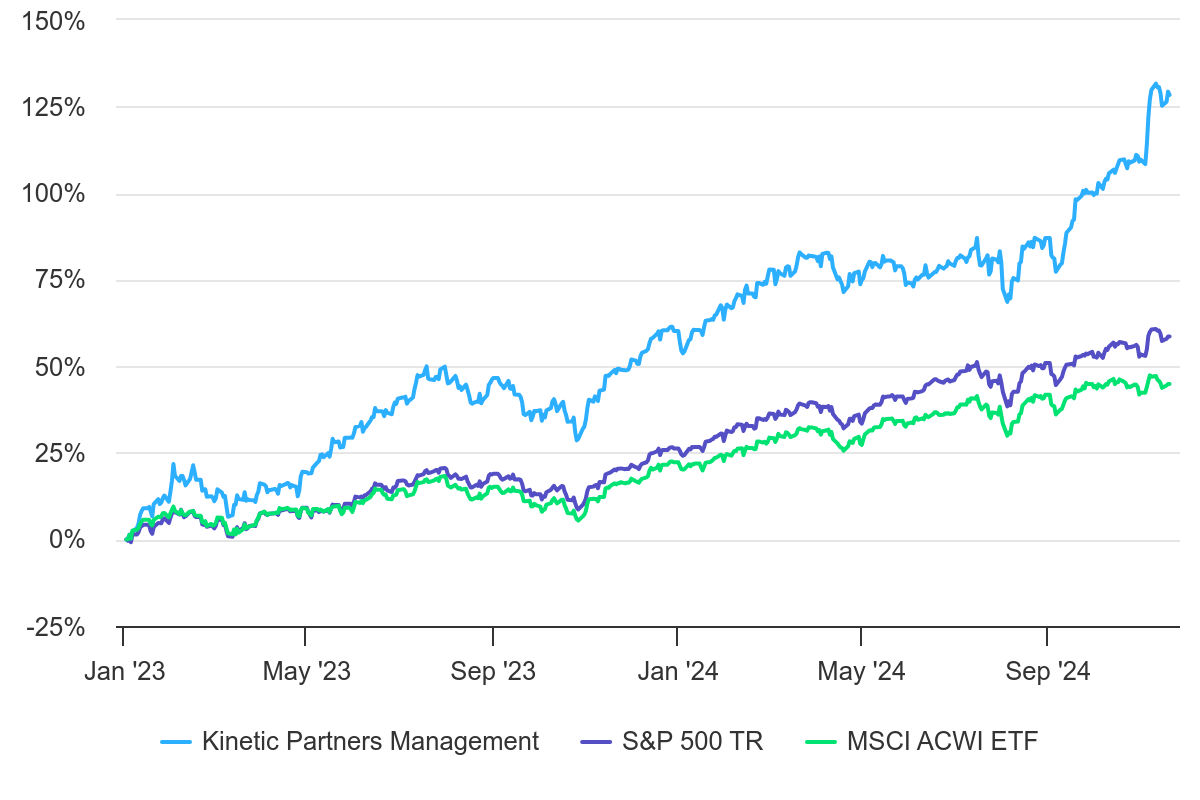

Kinetic’s disclosed positions have performed well since launch, driven by large gains in Amazon, DoorDash, GE Vernova, AppLovin, and Uber.

Kinetic Partners – Return of Disclosed Positions:

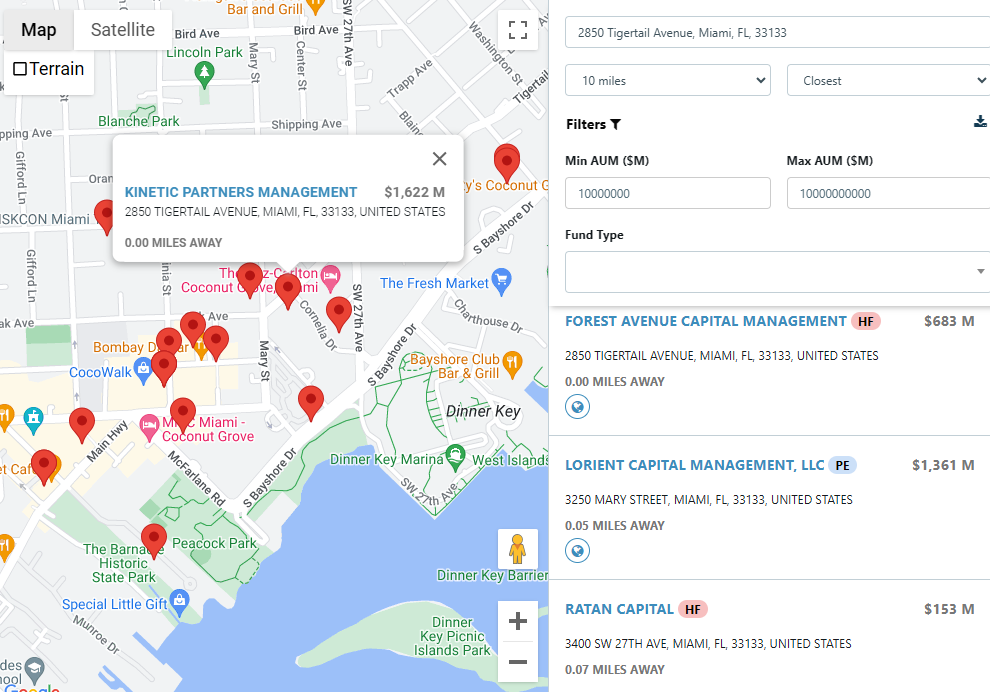

Kinetic is based in the Coconut Grove neighborhood of Miami. Using OWL’s map feature , our users can see that this is an increasingly popular home for managers:

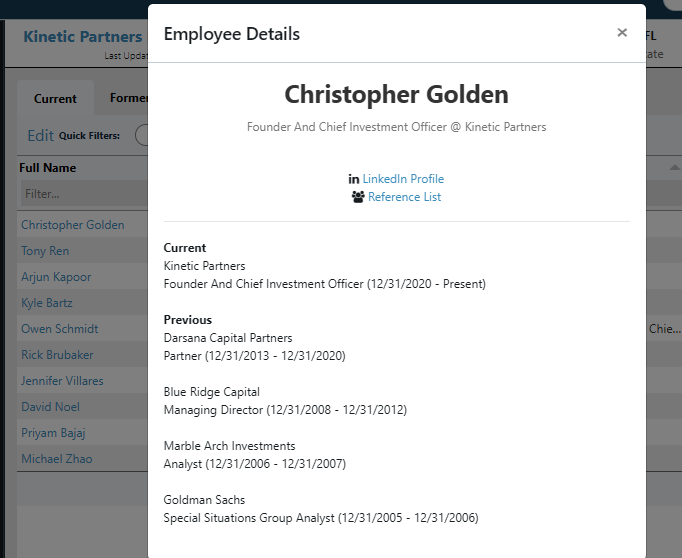

At OWL, we continue to invest heavily in our team data, adding over 13k employee profiles this week and updating more than 180k profiles with new information. For example, OWL users can quickly see Chris Golden’s history directly on the platform:

One great way to source managers in OWL is by using the “former employees” section for well-known managers. For example, despite Blue Ridge Capital shutting down, OWL continues to have a profile for Blue Ridge, and our users can track where their employees have gone since leaving the firm, a list that includes Kinetic and several other spinouts.

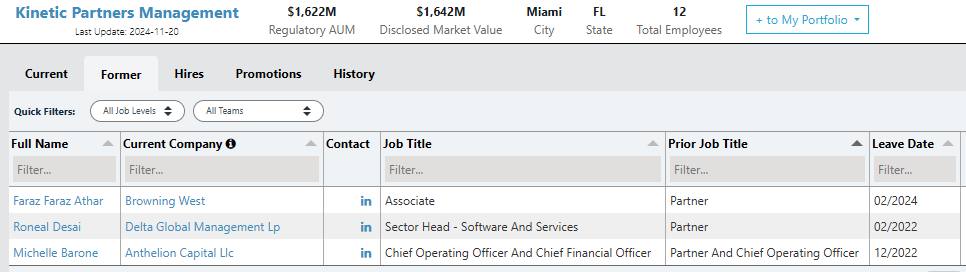

OWL users can track departures for over 12,000 managers, and this data is now linked to our email alert system. As a reminder, users who have set up a “My Portfolio” in OWL will get these alerts for the managers they follow. For Kinetic, OWL users can see that three Partners of the firm have left since launch, two on the investment team and also the COO:

Other News/Events

A profile of VCU Investment Management

Hound Partners sues Tiger Management over seed arrangement

Bridgewater co-CIO buys $12 million house in Hong Kong

Interview with retiring McArthur Foundation CIO on manager selection vs. asset allocation

University of Illinois returned 10.6% in FY24

Tufts returned 9.4% in FY24

Claremont McKenna returned 12.3% in FY24

Virginia Tech is hiring an Investment Manager

Virginia Retirement is hiring a private equity investment analyst.

LACERA is hiring a senior investment officer for private equity

JM Family is hiring an investment portfolio manager

Wellcome Trust is hiring an Associate Director

Please reach out anytime with questions, comments, suggestions, or ideas!

-The OWL Team

About Old Well Labs (OWL)

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Please feel free to selectively share these updates with high-quality allocators who might be interested in learning more about the system.

Reach out to learn how OWL can help you find, monitor, and connect with fund managers globally