Dear OWL Users,

Below, we provide highlights from this week’s 13F disclosures, but first, we look at which managers in Japan bought last week’s dip caused by the carry-trade unwind.

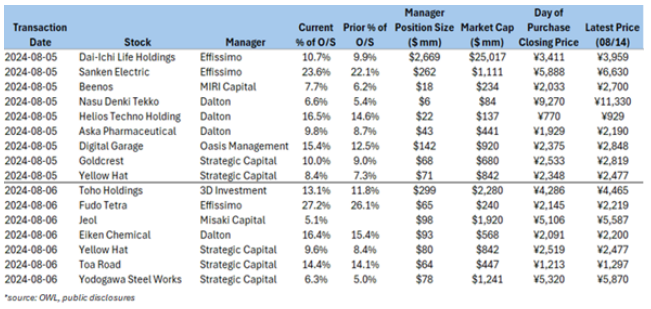

Filings in Japan are quite timely, particularly for activist and small-cap funds that frequently buy more than 5% of the shares of their target companies. Disclosures tracked in OWL show a spike of buying last week, particularly on August 5th , the day of the brief market panic in Japan:

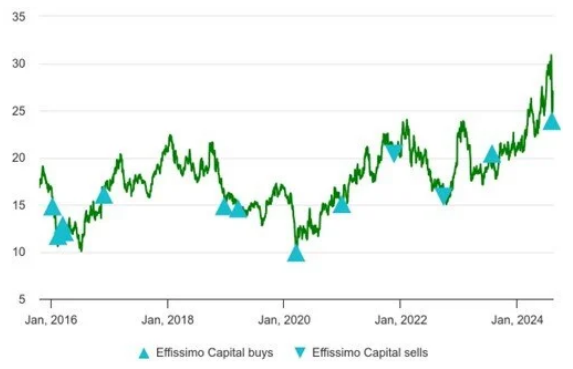

Effissimo was the most aggressive in terms of total dollars deployed, with its addition to Dai-Ichi Life alone estimated at $200 million. Effissimo now owns a position worth over $2.7 billion in the Japanese insurance company after adding to its stake several times since 2016:

Q2 13F Highlights

HMI Capital (backed by MIT and Boston Children’s ) doubled its position in Workday

Crows Nest , North Peak , Bares Capital , Keenan , Rivulet , Tencore , Reade Street , and others also bought shares in Workday during the quarter

Madison Avenue Partners (backed by Heinz and Robert Wood Johnson ) disclosed a new $145 million position in Solventum, a healthcare company spun out of 3M in March

Trian , Newtyn , and 683 Capita l also disclosed new positions in Solventum

Tiger Global established a new position in United Health that is worth over $1.3 billion

Thunderbird , Ruane Cunniff , 11 Capital , Route One , and Eagle Health all have large positions in UNH

Long Path Partners more than doubled its position in nCino, now the fund’s largest disclosed position, valued at $89 million

HMI added to its position in nCino, No Street Capital and Shawspring established new positions, while Dragoneer sold its position

Deep Track added to its position in Axsome Therapeutics, now worth $159 million

Axsome is Fairmount’s largest disclosed position, and several other biotech managers ( Checkpoint , RTW , BVF , Cormorant , Vestal Point , etc.) bought during the quarter

Grafton Street increased its position in Atlassian, now its second-largest disclosed positions

Oberndorf Family Office , Dragoneer, Foxhaven , and SRS all bought shares during the quarter, while Viking and Durable sold

Himalaya (backed by U of California , GHR Foundation , etc) established a position in Occidental Petroleum

Windacre (backed by Texas Teachers and U of Michigan ) bought a new position in Expedia

PAR Capital and Engine Capital also bought shares in EXPE during the quarter

Oceanlink (backed by MIT) bought a new position in Chinese freight dispatch platform Full Truck Alliance

The company is also owned by Ward Ferry , Brilliance , Greenwoods , and HongShan

Abrams Capital disclosed a position worth almost $3 billion in Loar Holdings, an aerospace company that went public during Q2

Abrams has been involved with Loar for many years, with David Abrams serving as a board member since the company’s inception in 2017

More Recent Filings

While 13Fs are amongst the least timely ownership filings due to their 6-week lag after quarter-end, OWL collects and processes filings daily from dozens of global sources, which are typically more timely than 13Fs. A small sample is below:

FD Technologies – Briarwood Chase increased its position in the UK software business earlier this month. Irenic Capital, Gumshow, and Newtyn all own shares as well

Truecaller – Yiheng Capital decreased its short position in the Swedish tech company on August 9th

MFE – VOR Capital added to its short in the Italian broadcasting company on August 12th

Fortnox – Gladstone, Kintbury, and Qube Research all disclosed short positions in the Swedish software company on August 14th , the same day that the CEO announced he was stepping down from the company

Please reach out anytime with questions, comments, suggestions, or ideas!

-The OWL Team

About Old Well Labs (OWL)

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Please feel free to selectively share these updates with high-quality allocators who might be interested in learning more about the system.

Reach out to learn how OWL can help you find, monitor, and connect with fund managers globally