12.15.23

Dear OWL Users,

This week, we'll look at the portfolio of Washington University (WashU), one of the most unique groups in the endowment world. CIO Scott Wilson was hired in late 2017 and was previously the CIO at Grinnell College. Grinnell's endowment has its own interesting and unique history, including a close relationship with Warren Buffett and a 10% seed investment into Intel:

"The endowment would make a second serendipitous investment when Robert Noyce, a Grinnell trustee and alumnus, offered Grinnell stock in his then-private start-up, NM Electronics. Noyce had almost been expelled from Grinnell for stealing a pig and roasting it at a campus luau. He would have been expelled but for the intervention of his physics professor who felt that Noyce was the best student he'd ever taught. The professor managed to persuade the school to reduce the expulsion to a one- semester suspension. Noyce never forgot the favor, and made the stock available to the school if it wanted it. Rosenfield told Noyce that the endowment would take all the stock he'd let it have. Grinnell's endowment took 10 percent of the $3 million private placement (Grinnell put up $100,000, and Rosenfield and another trustee put up $100,000 each). Shortly thereafter the company, then renamed Intel, went public in 1971." ( source: Concentrated Investing )

Since Wilson took over around five years ago, WashU has annualized returns of 11.2%, amongst the best-performing endowments over that time frame.

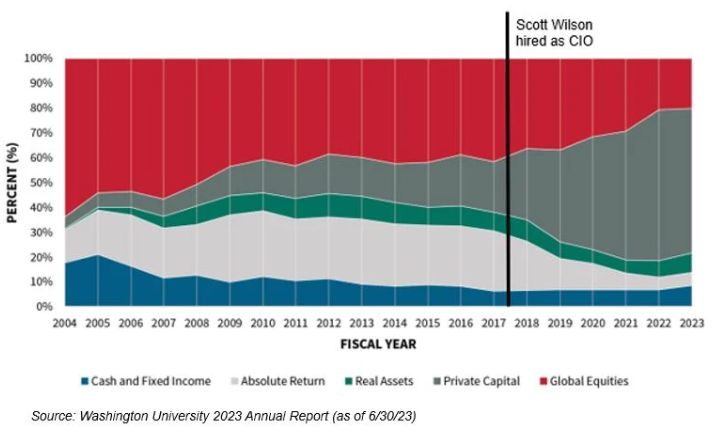

In a Capital Allocators interview in 2020, Scott noted that his team had turned over 70-80% of the portfolio in his first three years, focusing on making the portfolio more concentrated. Similar to many other endowments, Wash U's asset allocation has shifted meaningfully to private investments in recent years:

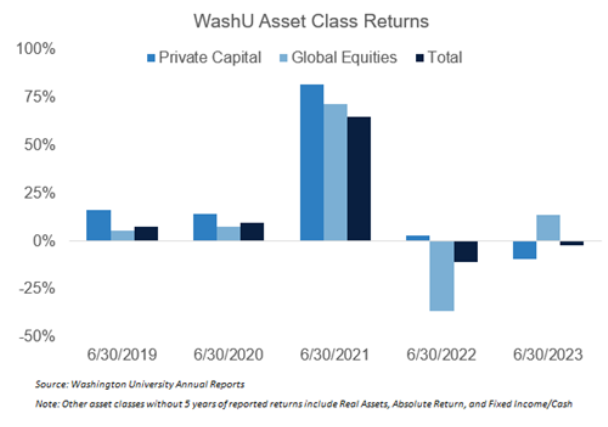

WashU reports the returns of its major asset classes, as seen in the table below. The endowment's incredible FY 2021 (+65% yoy) was driven by both Private Capital and Global Equities, while results have been more mixed over the past two fiscal years.

One of WashU's most unique characteristics is the team's heavy focus on scaling up manager positions through co-investments. This includes several directly held public equity positions that can be tracked in OWL , including significant positions in Nu Holdings and Coupang (each >$100 million). As Scott notes in his most recent letter,

"We gravitate toward managers that have the conviction to concentrate a substantial percentage of capital behind a small number of opportunities. When possible, we will work with these partners to augment exposure on the positions of highest conviction, understanding that this approach to concentration will likely lead to a higher tracking error and increase the volatility of the portfolio over shorter time horizons."

WashU's Managers

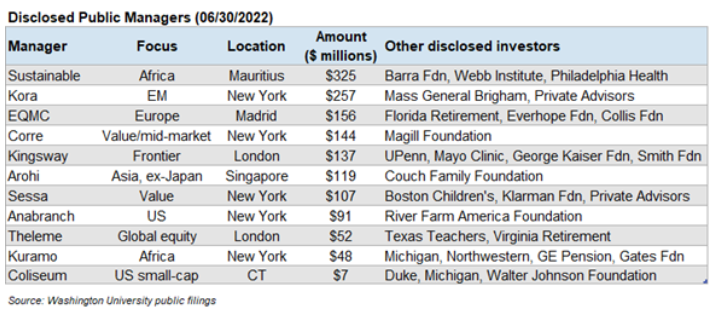

While public filings do not disclose all of WashU's manager investments, tax filings give us a glimpse into the endowment's manager relationships.

On the public side, WashU's disclosed holdings skew heavily toward emerging and frontier-focused managers like Sustainable, Kora, Kingway, and Kuramo. While some are fund investments, several of the disclosures list SPVs or co-investment vehicles as well. OWL users can see full details, including specific fund names, on WashU's allocator profile in the OWL system.

WashU's most recent filing disclosed an investment for the first time in Theleme , a global equity fund based in London. Theleme was founded in 2009 by Patrick Degorce, a former partner at TCI. When founding Theleme, Degorce was joined by former TCI partner Rishi Sunak, who left the firm in 2013 to pursue his political career (which one could argue has been fairly successful!)

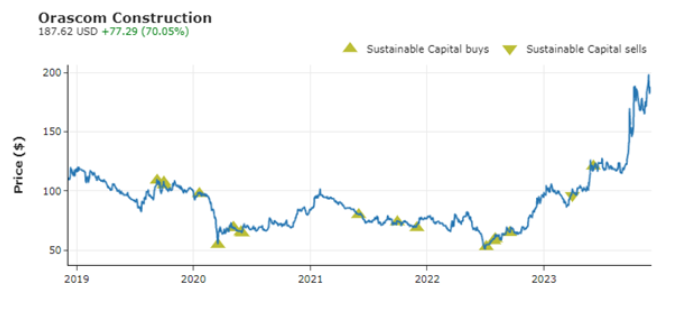

WashU first disclosed an investment in Sustainable Capital in FY 2020, disclosing an $80 million cash contribution during the year. Sustainable's Africa Alpha Fund reported an AUM of $482 million earlier this year. The firm, based in Mauritius, was founded in 2008 by Greg Barker and Kevin Macdonald. According to company disclosures , it has returned 52.6% in US dollar terms since inception vs. its benchmark of -13.6%.

Sustainable's largest disclosed position is Orascom Construction , based in Egypt. Sustainable initially disclosed a 6% stake in 2019 and has continued buying; it now owns more than 17% of the company.

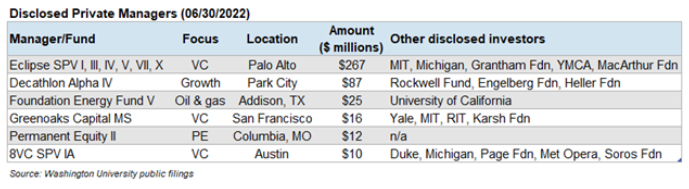

There are fewer private managers disclosed in WashU's filings, but a selection of manager relationships is in the table below:

Recent Buys/Sells

Cettire – Cat Rock sold a large block of stock on Nov 29th, reducing the fund's stake in the Australian online retailer from 13% to 9%

Lectra – EQMC (another WashU manager) disclosed a 5% stake in the French software company on Nov 20th

EyePoint Pharma – Cormorant bought shares on Dec 4th at prices ranging from $18.80 to $34.49/share, increasing the fund's stake in the company to almost 12%. On Dec 4th the company announced positive data from a phase 2 drug trial

Sapporo – 3D Investment Partners bought more shares in the Japanese beer company as recently as Dec 6th, increasing its stake in the company to almost 13%

Molecular Partners AG – BVF Partners bought shares in the Swiss biotech company as recently as Nov 17th, disclosing a 25% stake in the company

Please reach out anytime with questions, comments, suggestions, or ideas!

-The OWL Team

About Old Well Labs (OWL)

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Please feel free to selectively share these updates with high-quality allocators who might be interested in learning more about the system.

Reach out to learn how OWL can help you find, monitor, and connect with fund managers globally