8.25.23

Dear OWL Users,

With college football kicking off tomorrow, we thought we’d profile the investment portfolio of the University of Michigan, currently #2 in pre-season football rankings. When it comes to investing, Michigan’s endowment has returned 10.2% annualized over the last ten years (among the top 25 endowments) and 11.6% during the previous five years (among the top 20). OWL users can track the performance of over 200 colleges and universities on OWL’s endowment performance page .

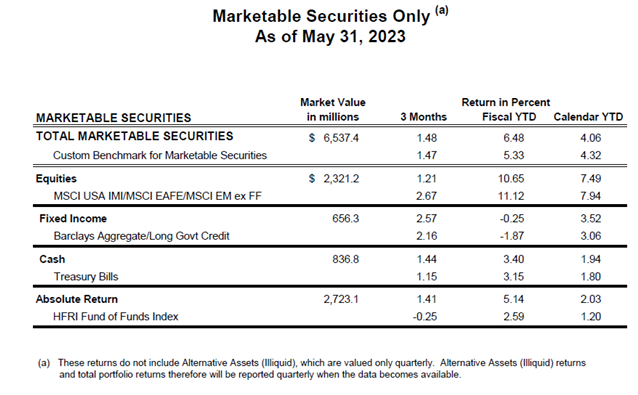

Michigan publicly discloses new manager investments made every 1-2 months on a state website after meetings of the University’s Board of Regents. While these are some of the timeliest allocator disclosures we track in OWL, there is no ongoing reporting of investment values or redemptions in this case. The reports also include monthly performance updates for Michigan’s marketable asset classes. The most recent performance update, as of May 31st 2023, is below:

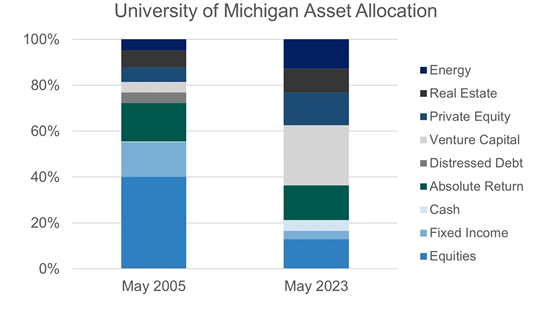

Like many other large endowments, Michigan’s asset allocation has shifted materially toward PE and VC. In 2005 (the earliest available data), its combined allocation to these asset classes was 11%, while today, it is more than 40%, with 26.2% of that in VC:

Michigan’s CIO, Erik Lundberg, has been at the University since 1999 and has grown the endowment pool from $2.5 billion to almost $18 billion today. He is the first and only CIO Michigan has ever had. Before his arrival, the university’s Treasury Office managed the endowment.

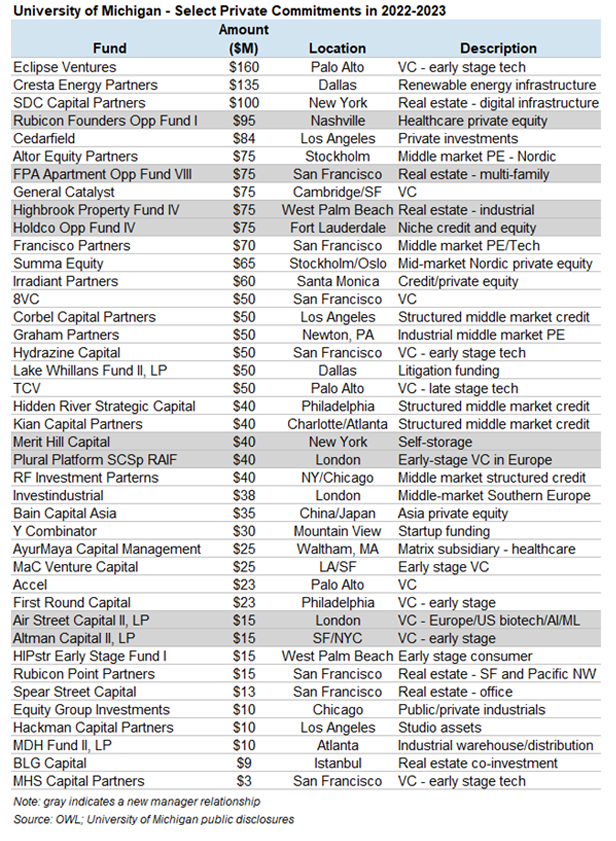

Most of Michigan’s recent investments have been in private managers, including several early-stage VC funds and various PE, credit, and real assets funds. Managers in grey are new relationships, while the remainder are new investments with existing managers:

Michigan is also invested in several large VC funds, including Sequoia, with whom they have invested since 1992, and Matrix Partners, with whom they have invested since 1995. The complete list of their investments is available for OWL subscribers on Michigan’s profile page .

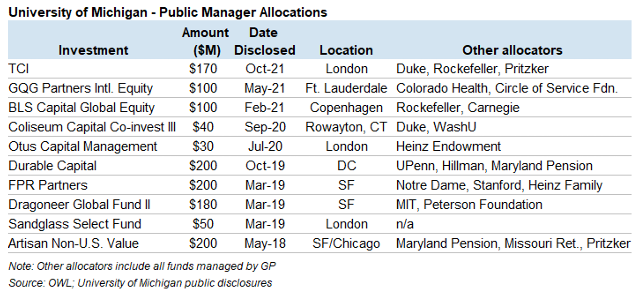

Michigan’s public investments have been fewer but more substantial. Recent public commitments are detailed below. Notably, the school has not disclosed any new hedge fund or public equity commitments since late 2021:

In May 2021, Michigan’s board also approved an internally managed direct equity portfolio comprising up to 2% of the overall portfolio. The memo describes the internal equity strategy as a systematic, rules-based approach using quantitative tools and optimization, with a minimum of 30 stocks. We have not seen any disclosures regarding their direct equity portfolio.

One significant commitment to a public manager was Michigan’s $100 million investment in BLS Capital based in Denmark, in February 2021. Per the memo to the board:

"Peter Bundgaard and Anders Lund founded BLS Capital in 2008 with the goal of creating an investment boutique where stock picking and the ability to steadily deliver attractive long-term risk adjusted returns at the core of the business. BLS believes that high quality companies are characterized by robust and superior business models with stable, predictable and growing free cash flows, generating high returns on invested capital. A significant emphasis is placed on selecting management teams with a proven track record of shareholder friendly capital allocation decisions and the maximization of long term shareholder value. BLS invests in a concentrated portfolio of high quality companies and maintains a long term time horizon. Valuation is an important component of the investment process, but the manager will always focus on quality as the primary driver for the underwriting process. The strategy invests globally and tends to be biased towards large cap companies."

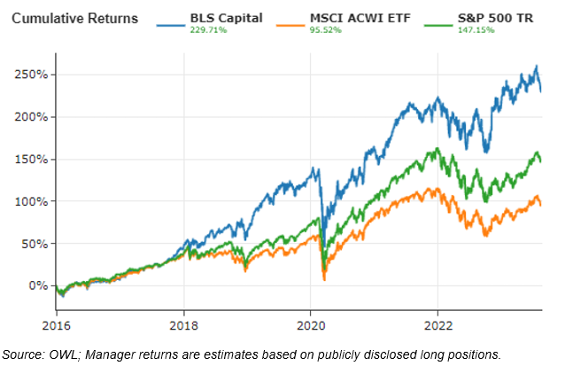

Since OWL started tracking BLS’s disclosed positions in 2016, BLS has annualized returns of 16.4%, nearly double the ACWI at 8.9%:

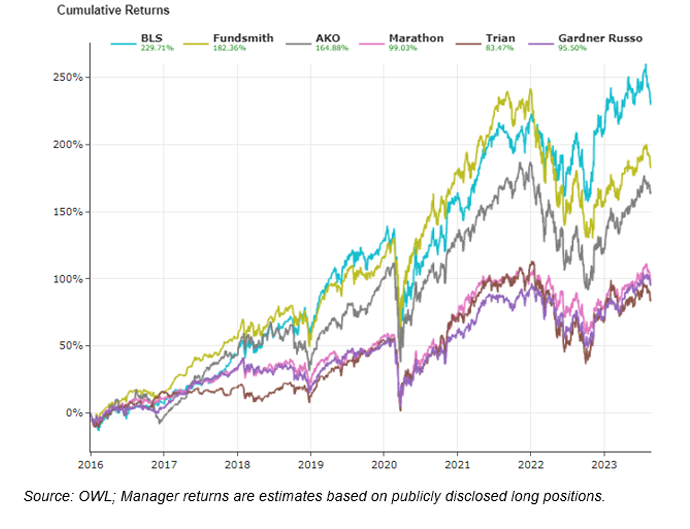

One unique report we offer for all 4,000+ managers in the OWL system is the “similar managers” view, which systematically shows other groups whose returns are highly correlated with the selected manager. BLS’s automated peer group is in the table below, which also shows BLS’s strong performance relative to other quality-focused peers:

BLS’s second largest disclosed position is in St James’s Place, a British wealth management business with historical ties to Jacob Rothschild. BLS has increased its position several times, including buying more shares last week on August 16th, which was disclosed via regulatory filings a few days later. BLS now owns over 8% of the company, for a stake worth almost $500 million.

Please reach out anytime with questions, comments, suggestions, or ideas!

-The OWL Team

About Old Well Labs (OWL)

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Please feel free to selectively share these updates with high-quality allocators who might be interested in learning more about the system.

Reach out to learn how OWL can help you find, monitor, and connect with fund managers globally