Dear OWL Users,

This week, we’ll take a look at the portfolio of the Pierpont Morgan Library, a foundation based in New York. The Morgan Library was initially built between 1902-1906 as J.P. Morgan’s personal library, adjacent to his home on 36th and Madison in New York. It was primarily built for his extensive book collection, which was spread out across several homes in the US and England. At the time, the majority of his art collection was kept in England due to a 20% tax on art and antiques imported to the US.

In 1924, 11 years after his father’s death, J.P. Morgan, Jr. opened the library to the public and established it as a non-profit foundation. The building itself has expanded over time - in 1928, J.P. Morgan’s house was replaced with an Annex to the Library, and in 1988 his son’s former residence was added to the collection. An additional wing was completed in 2006, adding 75,000 square feet, including a performance hall. In addition to rare books, the Library’s collection today includes historical manuscripts and rotating art exhibitions.

J.P. Morgan’s original library

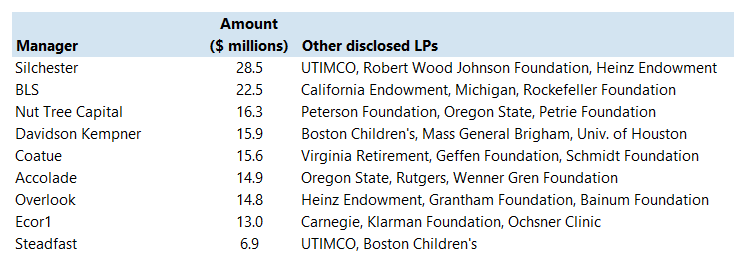

Given the relatively small size of the Library’s endowment portfolio (~$300 million), it is likely managed by an outside advisor (OCIO/consultant), but no details of the relationship have been disclosed in recent years. The table below shows a selection of managers from the Morgan Library’s portfolio:

Source: Morgan Library disclosures as of 3/31/24; OWL

Accolade Partners

One manager disclosed by the Morgan Library is Accolade , a fund-of-funds focused on venture capital, growth equity, and blockchain funds in the tech and healthcare spaces. Based in DC, the firm was founded in 2000 by Joelle Kayden after 18 years at Alex Brown.

Joelle Kayden

While Accolade does not typically disclose the funds it has invested in, media reports note that it has backed VC firms including Accel , Andreessen Horowitz , and Kleiner Perkins . In 2021, Accolade disclosed a small number of crypto managers it had invested with including Andreessen , Polychain , and Standard Crypto.

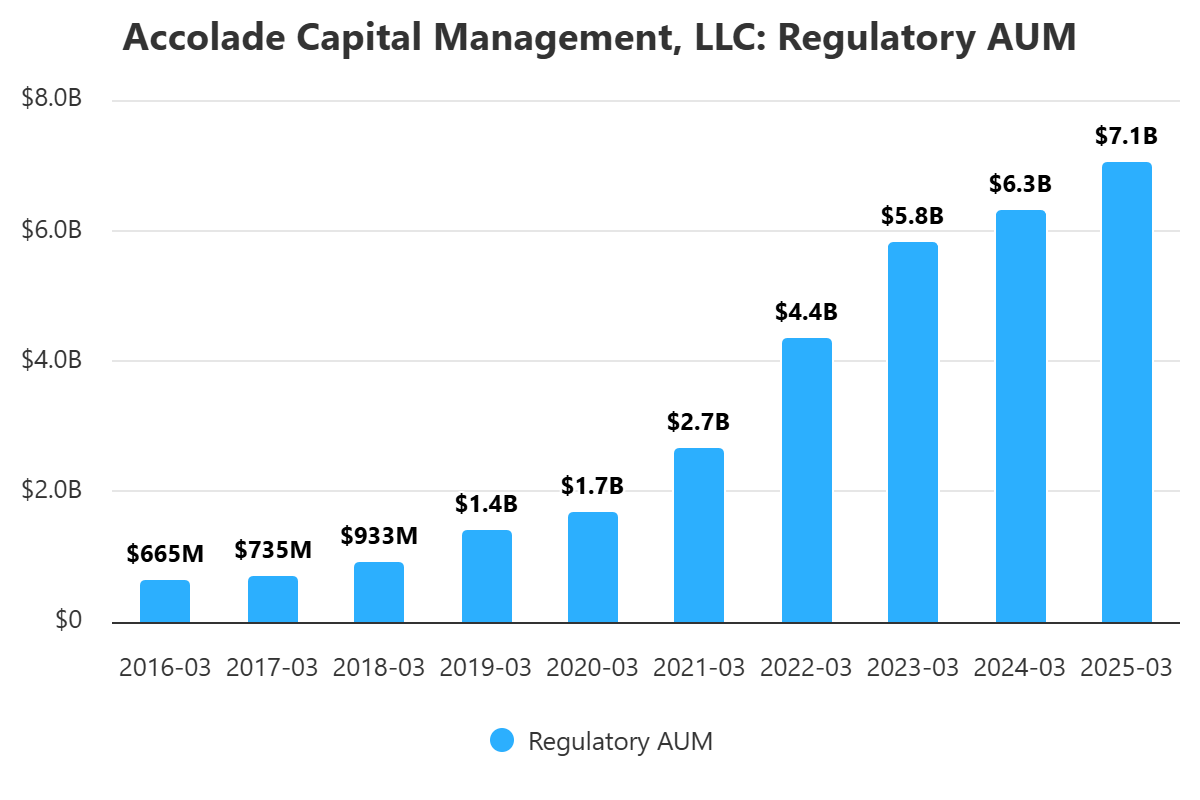

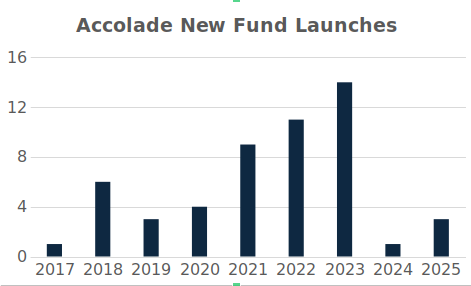

Accolade’s AUM has grown substantially over the past 10 years, driven partially by new fund launches, which peaked in 2023 with 14 newly disclosed vehicles.

Source: OWL; Regulatory filings

Source: Regulatory filings; OWL analysis

Note: Data represents fund vehicles newly disclosed in each year’s ADV; OWL fund data begins in 2016

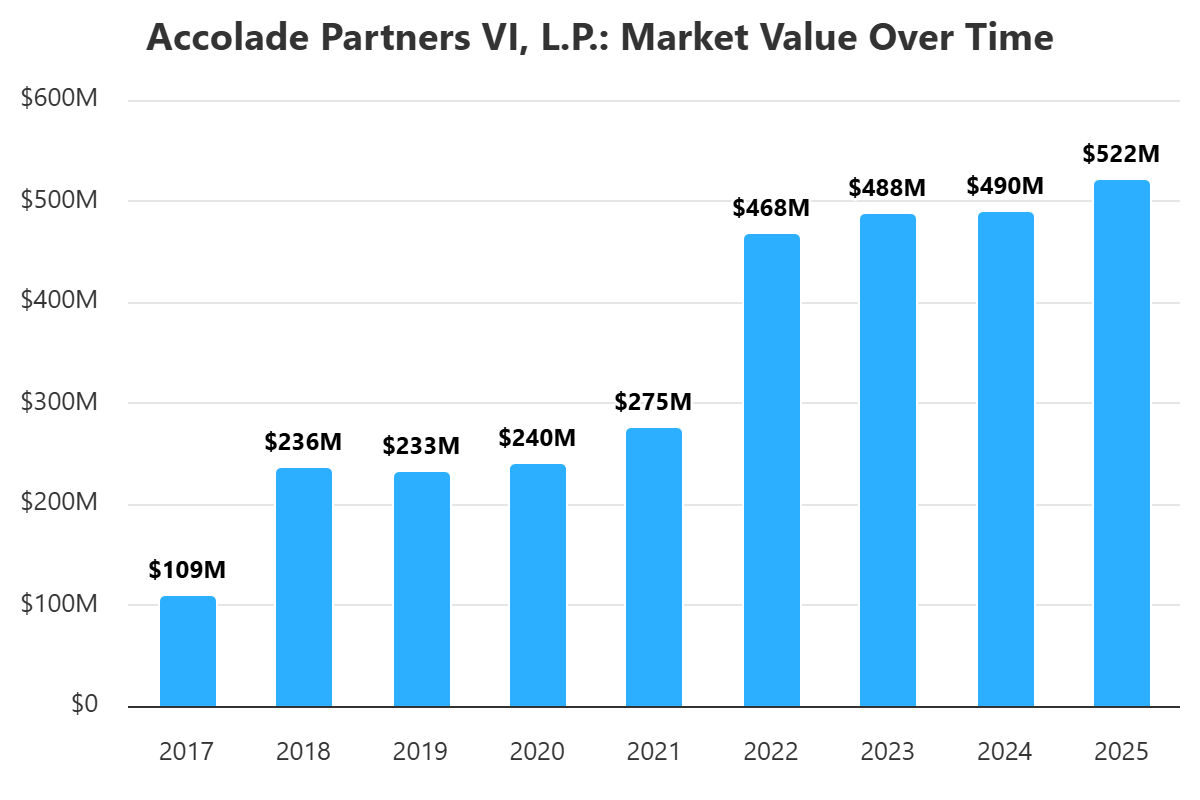

Looking at historical filings more closely, we can see that the Morgan Library invested specifically in Accolade Partners VI in 2017, which focuses on VC and growth equity and closed with a hard cap of $235 million in April 2017.

As a reminder, in addition to manager-level metrics, OWL users can see fund-level details (like Fund VI’s AUM over time below) for thousands of managers, enabling them to monitor not only a manager’s business overall, but the growth of specific funds of interest:

Recent Buys & Sells

Evolent Health – Durable disclosed a 7.8% position in the healthcare software company on 7/7

Tripadvisor – Starboard Value disclosed a 9% stake in the company on 7/3; River Road and Holocene also have positions in the company.

Saipem – Elliott disclosed a 0.6% short position in the Italian oil & gas company on 7/3

BridgeBio Pharma – Viking Global reduced its position to 9.8% from 11.7% of the company on 6/27

Other News & Events

US public colleges expand PE investments despite downturn (using OWL data!)

Bryn Mawr’s CIO on Liquidity and Navigating Market Turbulence

Citadel hires a chief medical officer as Ken Griffin pushes for 'peak performance'

Dartmouth Joins Ivy League Bond Boom With $456 Million Debt Sale

Chris Hohn’s hedge fund TCI beats stock markets with 21% gain

Please reach out anytime with questions, comments, suggestions, or ideas!

-The OWL Team

About Old Well Labs (OWL)

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Please feel free to selectively share these updates with high-quality allocators who might be interested in learning more about the system.

Reach out to learn how OWL can help you find, monitor, and connect with fund managers globally