1.26.24

Dear OWL Users,

This week, we’ll focus on Stanford ’s endowment, a $40 billion pool managed by Stanford Management Company. CIO Robert Wallace joined Stanford in 2015 after ten years at Alta, a large family office based in London. Before Alta, Robert worked in the Yale investment office, served on the investment committee at Cambridge University, and danced professionally for 16 years with the American Ballet Theatre, the Boston Ballet, and the Washington Ballet.

Over the past ten years, Stanford has annualized returns of 9.5%, behind leaders like MIT and Yale (11.5% and 10.9%, respectively) but above average among the top endowments we track in OWL.

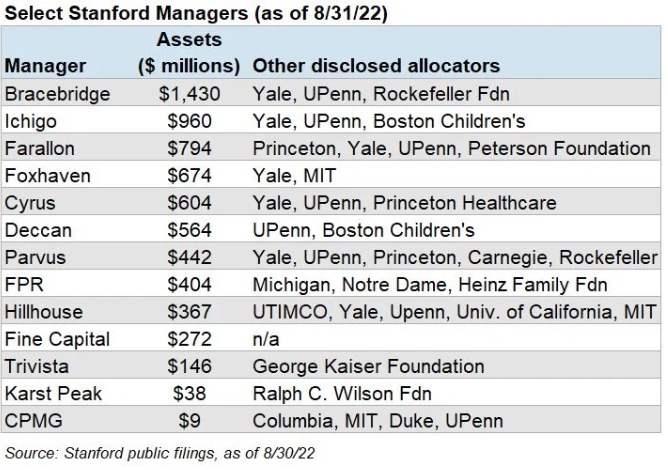

While Stanford’s public filings do not disclose their entire portfolio, tax filings do give us a glimpse into some of their manager relationships. As we noted when we profiled UPenn's portfolio a few months ago, there is significant overlap between Yale and other endowments with former Yale investors at the helm, including Stanford:

One interesting note about these disclosures is that not a single manager name listed in the left column above shows up in the source documents that we collect for OWL. For example, the investment in Ichigo appers as an investment in “Kaizen Fund,” which we were able to map to Ichigo via other regulatory disclosures, including form ADVs. OWL users can access all the details, including specific fund names, in the OWL allocator database.

Form ADVs, which include data such as AUM over time, funds managed, changes in ownership, service providers, legal proceedings, etc., have been a top priority for the OWL team in recent months. We’re excited to roll out new data and features around this in the coming weeks!

CPMG’s Flock of Funds

In June, we highlighted CPMG in our issue focused on Duke’s portfolio. The firm was founded by the late short-seller Rusty Rose in 1974 and has had success investing in a concentrated portfolio of biotech longs in recent years.

CPMG is another interesting example of how we use ADVs to identify allocations to managers. In their most recent ADV, CPMG discloses 30 different sub-funds, all of which have different bird names. For example, Stanford is invested in the Sandpiper Fund,

UPenn is invested in the Gallopavo Fund (another name for a wild turkey), and, of course, our favorites are the Snowy Owl and Barred Owl funds.

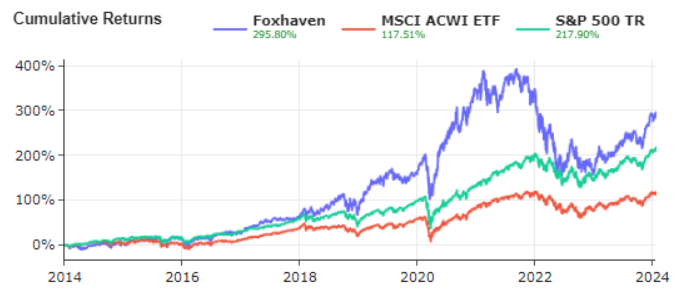

Speaking of animal-themed fund names, Foxhaven is a large investment for Stanford, along with both Yale and MIT. Based in Charlottesville, the firm was established in 2013 by Mike Pausic and Nick Lawler. Before founding the firm, Pausic and Lawler were on the TMT team at Maverick for many years. Foxhaven’s disclosed long positions have annualized returns of 14.1% over the past ten years, compared to the ACWI at 7.8%:

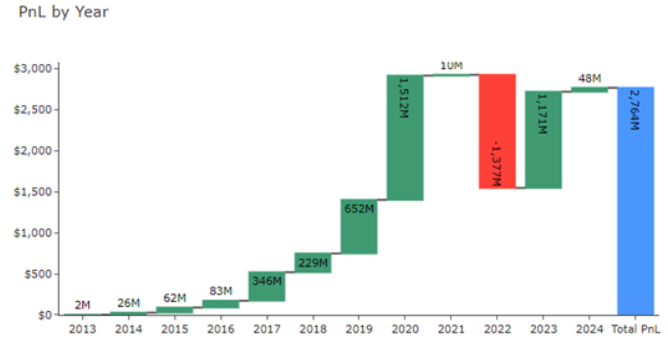

Foxhaven currently manages ~$4.4 billion in assets, and we estimate that the fund has earned nearly $2.8 billion in profits on their long positions over the last ten years:

One relatively new position for Foxhaven is Ferguson , a plumbing and HVAC supplier. The stock has appreciated meaningfully in recent years, and we estimate that Foxhaven has generated a profit of $87 million on $179 million in cash invested. Other holders of Ferguson include 59 North , Crows Nest , TCI , and Alfreton .

Recent Buys/Sells

AU Small Finance Bank – Janchor disclosed a new $70 million position in the India-based bank as of year-end. Westbridge also added to its position in Q4.

Just Dial – Hara Global added to its position in the Indian search company, disclosing a 1.2% stake as of year-end.

BT Group – AKO added to its short position in the British telecom company on 1/23.

Elekta – Gladstone added to its short position in the Swedish healthcare company on 1/22.

Gabia – Miri Capital added to its stake in the Korean tech company, buying shares as recently at 1/8.

Nkarta - Boxer Capital opened a position in the oncology-focused biopharma company. The fund owns 9% of the shares, which was disclosed on 1/23.

Please reach out anytime with questions, comments, suggestions, or ideas!

-The OWL Team

About Old Well Labs (OWL)

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Please feel free to selectively share these updates with high-quality allocators who might be interested in learning more about the system.

Reach out to learn how OWL can help you find, monitor, and connect with fund managers globally