10.3.23

Dear OWL Users,

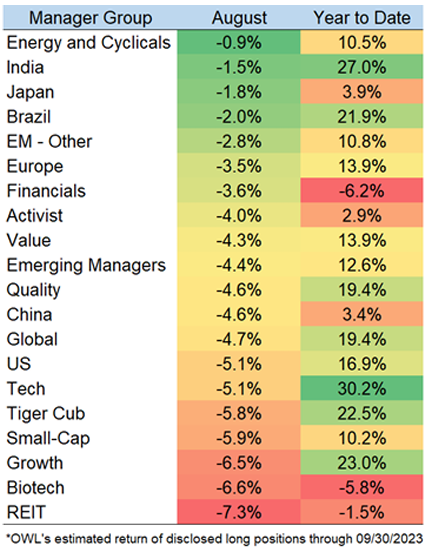

All manager groups experienced losses in September, with funds focused on REITs, Biotech, and Growth seeing the worst returns. As always, OWL’s returns are estimates based on managers’ disclosed long positions.

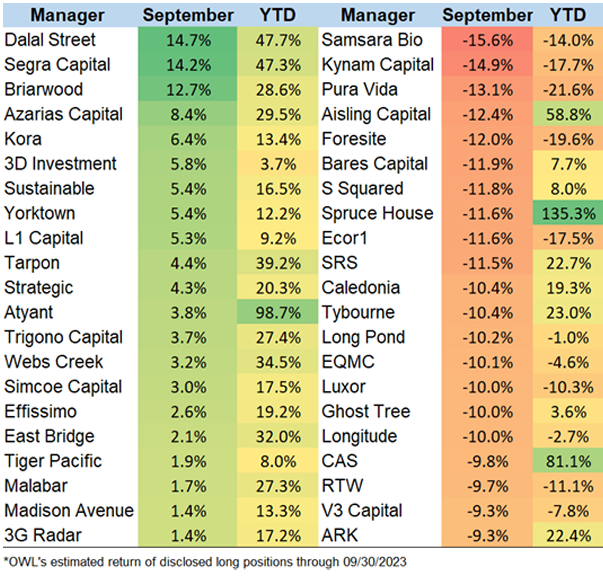

The table below shows a selection of the best and worst manager returns. Funds with significant Energy exposure performed relatively well, while Biotech and Tech-focused managers were hit particularly hard during September.

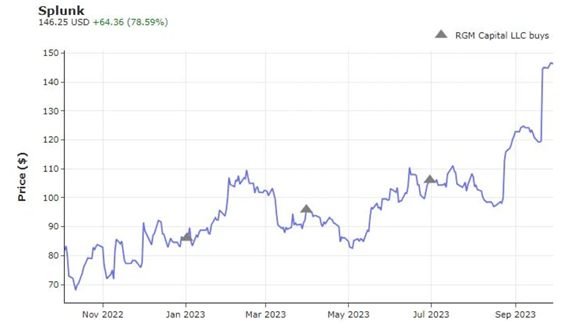

Despite the group losses, there was wide dispersion within manager groups, and several individual stocks gained during the month. One example is Splunk, the software business that Cisco announced an intention to acquire for $28 billion. One of the most significant winners from the acquisition was RGM Capital , a software-focused manager founded by Robert Moses 20 years ago in Naples, Florida. RGM acquired a 0.6% stake in Splunk over the past three quarters, worth $143 million today:

RGM manages $2.2 billion in assets, with disclosed LPs including Duke University , the YMCA Retirement Fund , the Conrad Hilton Foundation , the Bobolink Foundation , and the Moore and Rainwater Foundation .

RGM describes its strategy in a 2020 letter that is publicly available:

"RGM Capital, LLC is a value‐oriented investment manager with a focus on publicly traded equities generally ranging from $500 million to $5 billion in market capitalization. We manage a concentrated portfolio (approximately 20 positions) and employ a private equity‐like approach toward our investments through what we term "value‐added activism," which includes ongoing dialogue and idea sharing with company managements and boards about value‐creating initiatives."

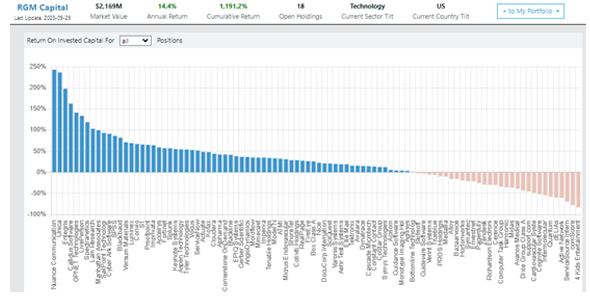

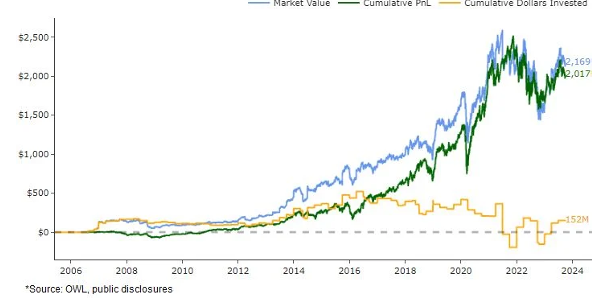

With a portfolio primarily focused on software companies, RGM’s performance has been particularly impressive in recent years, with strong outperformance relative to other tech managers during the recent industry drawdown:

Splunk is the latest in a large number of acquisitions within RGM’s portfolio over the years, one factor that has led to an impressive batting average for the fund. The report below highlights the return on invested capital for each of RGM’s positions since inception and is available for any manager in OWL on the “Batting Average” view.

Using OWL’s data, we can also estimate that most of RGM’s growth in AUM is from profits generated within its portfolio. On the “Cumulative P&L” view , OWL estimates that RGM has created over $2 billion in profits since inception versus a market value today just under $2.2 billion.

Please reach out anytime with questions, comments, suggestions, or ideas!

-The OWL Team

About Old Well Labs (OWL)

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Please feel free to selectively share these updates with high-quality allocators who might be interested in learning more about the system.

Reach out to learn how OWL can help you find, monitor, and connect with fund managers globally