11.2.23

Dear OWL Users,

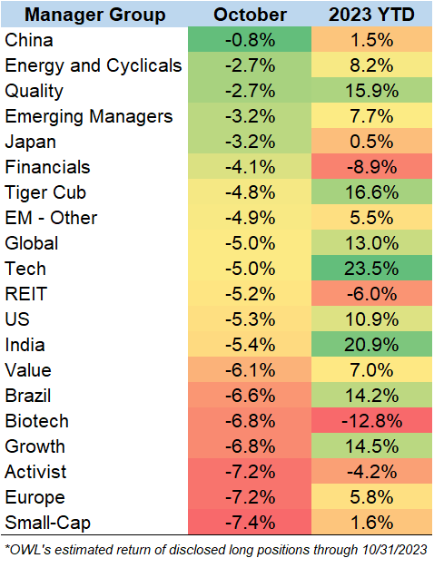

All manager groups tracked in OWL experienced losses on their disclosed long positions for a second straight month. Funds focused on China, Energy, and Quality saw the best relative performance.

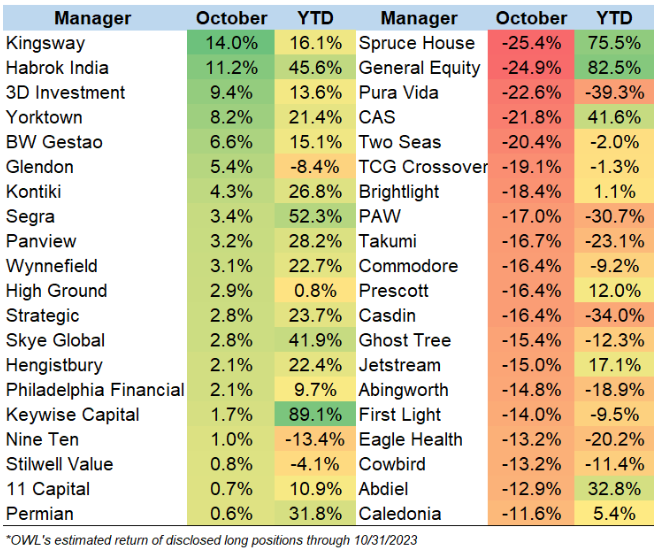

The table below shows a selection of the best and worst manager returns. Growth and Biotech-focused managers struggled, with several from each group among the lowest returns. OWL estimates that Pura Vida , the worst-performing OWL Biotech manager in October and 2023, has erased almost all gains since inception during their current drawdown.

3D Investment Partners

In our recent Japan update , we noted the increased dispersion we have witnessed recently among managers focused on Japan. While this dispersion continued in October, one of the best returns came from Japan-focused 3D Investment Partners,

Based in Singapore, 3D was founded in 2015 by Kanya Hasegawa , formerly a partner at Broad Peak. 3D's website describes its strategy as "Japan-focused opportunistic value investing with an emphasis on business quality." 3D is also well known for its involvement in several high-profile activist campaigns, including Toshiba, which resulted in a $14 billion privatization at the hands of Japan Industrial Partners. 3D's disclosed LPs include RIT Capital , which we wrote about two weeks ago, and Carnegie Corporation.

3D's largest disclosed position today is Fuji Soft, which was also the primary driver of October's performance. The fund first disclosed a position in late 2021 and, after several additional purchases, now owns over 21% of the company, a stake worth $525 million. 3D has several engagement proposals directed at the company.

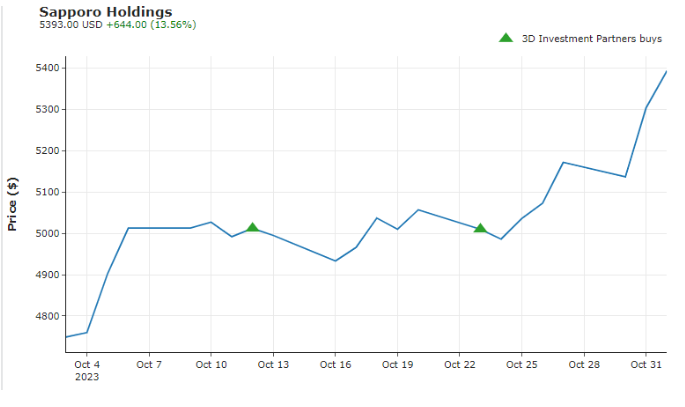

In recent weeks, 3D has disclosed purchases of several other names, including a 6% stake in Sapporo Holdings. The manager had previously launched an activist campaign against the beverage company with several proposals it believes will drive shareholder value.

Product Update – Historical Positions

This week, we added a new manager view that displays the historical changes across a manager's portfolio in one place. This feature was requested by several of our users – please let us know any feedback, and keep the ideas coming!

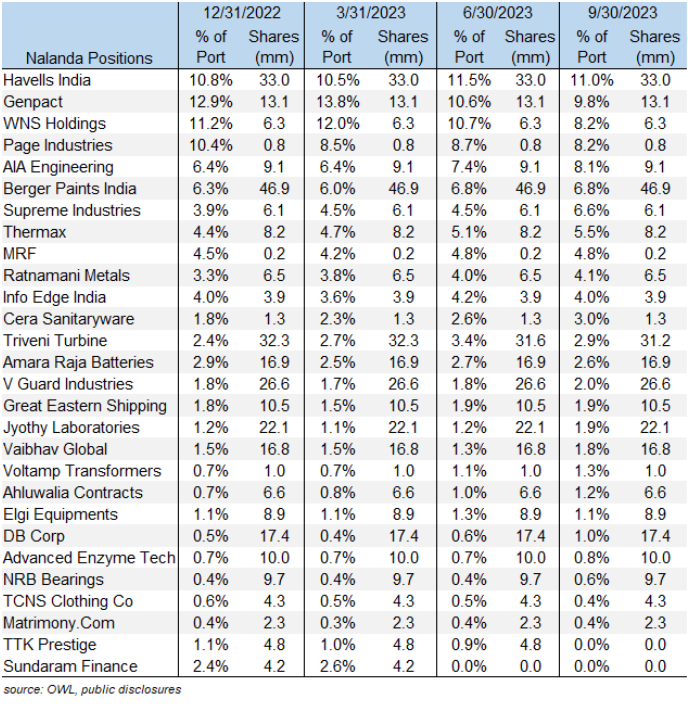

This view is found by clicking "Historical Positions" on the left side of any manager page in OWL and displays the size of each position (% of disclosed portfolio) and # of shares every quarter:

Recent Buys/Sells

Viridian Therapeutics – Fairmount bought shares on 10/30 as part of the company's private placement

Longi Green – Hillhouse bought a small amount of additional A-shares in Q3 and now owns $1.2 billion of the company

Grupo de Moda SOMA – Atmos disclosed a 5% position in the Brazilian clothing manufacturer on 10/18

Infomart – Symphony purchased additional shares in Infomart on 10/25, reaching 17% ownership

Ambrx Biopharma – Cormorant added to its position on 10/23

Please reach out anytime with questions, comments, suggestions, or ideas!

-The OWL Team

About Old Well Labs (OWL)

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Please feel free to selectively share these updates with high-quality allocators who might be interested in learning more about the system.

Reach out to learn how OWL can help you find, monitor, and connect with fund managers globally