9.22.23

Dear OWL Users,

MIT recently filed the annual update for a retirement plan that discloses the managers the University invests with. The plan composes over $5 billion of the ~$25 billion managed by MITIMCO, and we believe the list of investments is representative of MIT’s overall portfolio.

Over the past ten years, MIT has returned 13% annualized, behind only Bowdoin at 13.3%. Over the past five years, it has produced 14.5% annual returns, amongst the top five best-performing endowments. As a reminder, OWL users can track these numbers using OWL’s endowment performance tracker , which will be updated for fiscal year 2023 returns as they are released in the coming weeks.

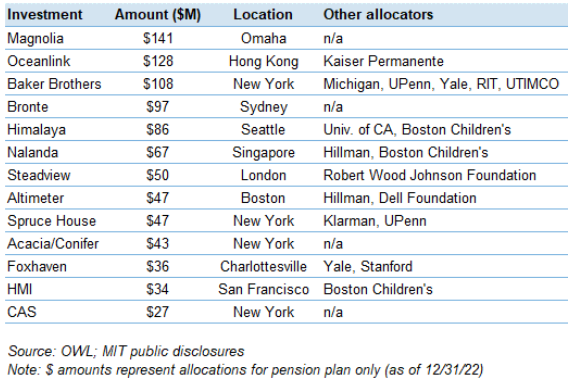

The table below includes a selection of MIT’s largest public managers. The entire list is available to OWL users on MIT’s holdings page.

MIT’s filings disclose calendar year-end investment amounts, and the changes from the prior 2021 report reflect the difficult 2022 experienced by many fundamental equity managers. For example, the dollar amount invested with CAS decreased 77% during the year, consistent with OWL’s estimated 2022 return of -78% for CAS. Several of the hardest-hit managers in 2022 have seen significant rebounds thus far in 2023, including CAS and Spruce House, which are up an estimated 80% and 140% year to date, respectively.

In its public portfolio, MIT disclosed a new investment with Philosophy Capital Management , which we knew about a few months ago from a separate MIT disclosure and recently mentioned in our Duke profile. MIT also disclosed an investment in Pleasant Lake Partners for the first time.

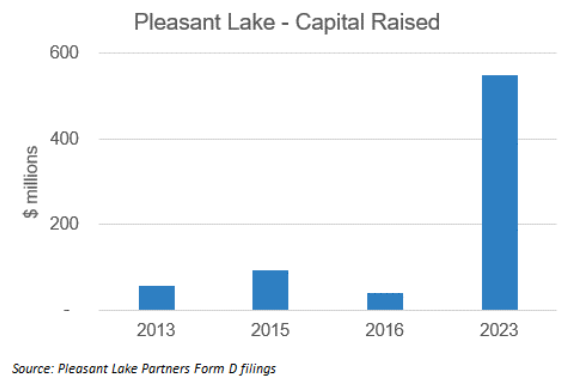

Jonathan Lennon is the founder and PM at Pleasant Lake, a long/short fund based in Puerto Rico. Lennon initially raised capital between 2013-2016 after leaving JAT Capital. The firm then went quiet for several years, with no disclosures such as 13Fs or ADVs, before re-launching recently with backing from MIT and Blackstone.

This unique history can be seen in the data from Pleasant Lake’s form D disclosures below. Form Ds are public disclosures where managers report new capital raised each year and are one of the data sets we are working to add to OWL.

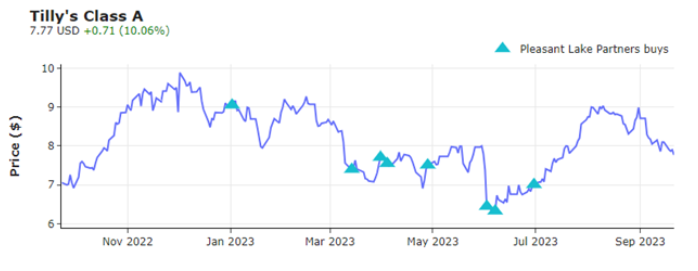

Pleasant Lake’s long portfolio today is heavily invested in small-cap consumer names, the largest of which is a ~$50 million stake in Tilly’s, a specialty retailer. Over the past two years, Pleasant Lake has bought over 20% of the company and has continued to add to its position in recent months. Newtyn , Shay Capital , and Divisar Capital also have meaningful stakes in Tilly’s.

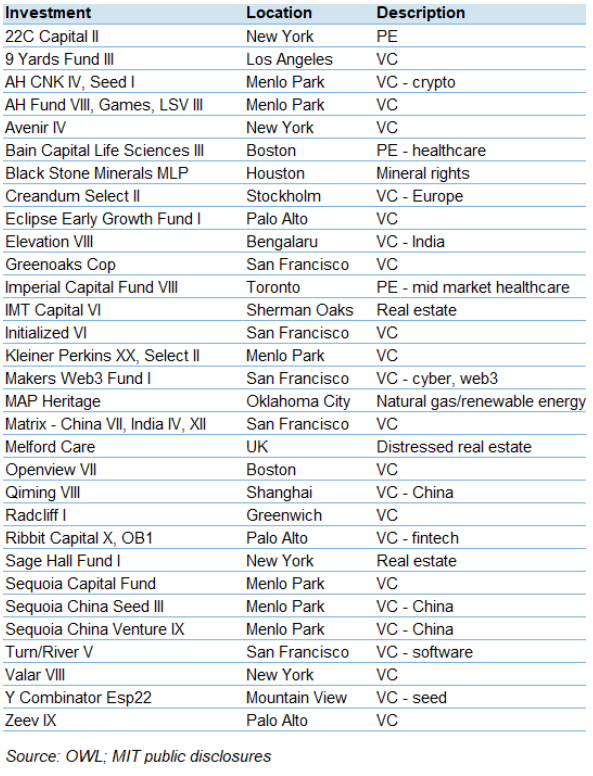

In its private portfolio, MIT continues to have a heavy focus on VC investments. Below is a table of new investments made across MIT’s private portfolio during 2022.

For more reading on MIT, we enjoyed this piece published yesterday by Adam Shapiro of East Rock Capital.

Please reach out anytime with questions, comments, suggestions, or ideas!

-The OWL Team

About Old Well Labs (OWL)

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Please feel free to selectively share these updates with high-quality allocators who might be interested in learning more about the system.

Reach out to learn how OWL can help you find, monitor, and connect with fund managers globally