10.11.24

Dear OWL Users,

This week we’ll look at updates to MIT’s manager roster from recently filed disclosures. MIT, like several other large endowments, discloses many of its investments in a variety of publicly available tax and regulatory forms. OWL users can view full details for MIT and thousands of other LPs using OWL’s allocator holdings database.

As we wrote about in our profile of MIT last year, the endowment has been run by Seth Alexander since 2006 after working under David Swenson at Yale.

During Alexander’s tenure, MIT has embraced investing in emerging managers, as he explained in a 2022 letter:

"Historically, we sought out established firms with long track records of success. Such firms were easier to diligence, quick to get internal approval and much less likely to result in disastrous return outcomes. Unfortunately, these firms were also harder to develop relationships with..."

"As an experiment, we began to target smaller, more off-the-run managers such as brand-new firms, firms started by people who did not have ’traditional’ backgrounds, firms delving into new arenas, firms with unusual organizational and fund structures and any other type of firm that did not match the typical institutional playbook."

According to the 2022 letter, MIT has been the first or among the first institutional investors in over 50% of their new relationships for several years now. Given MIT’s success with emerging managers, it’s interesting to note that Yale recently launched the Prospect Fellowship , an incubator program for new investment managers. Under this program, Yale will lend new managers up to $2 million in working capital and an investment of at least $25 million.

At OWL, we're passionate about discovering and tracking emerging managers. In our recent piece, “Tracking Spinouts" , we discussed how we are continually building tools to help allocators identify new managers.

Tracking the disclosed investments of leading allocators is another powerful method for identifying early-stage managers. In MIT’s case, two recently disclosed examples are Kynsna Capital , an $8 million equity fund in South Africa, and Twin Lions Management , a $43 million long/short fund launched by Timothy Abbott, who previously worked at Hound Partners and CPMG.

While MIT manages over $25 billion, some of the most detailed disclosures come from a $5.3 billion retirement plan that the investment office manages. The table below shares a selection of the largest investments disclosed in the retirement plan. This is only a portion of the assets and disclosures for MIT, and OWL users can see the full list here.

Browning West was founded in 2019 by Usman Nabi and Peter Lee . Nabi, who serves as CIO, was previously a senior partner for several years at H Partners. Browning West runs a concentrated, long-term portfolio where they take an activist approach. Aside from MIT, Browning West also counts Howard Hughes Medical Institute as a notable LP.

Browning West has four disclosed positions that make up virtually all of the firm's $1.5 billion of disclosed AUM: Tempur Sealy, Gildan Activewear, Domino’s Pizza Group (UK), and Vistry Group. In each of these companies, the firm has successfully won a board seat and been involved with implementing management changes. Tempur Sealy, the firm’s largest position, is a holdover position from a prior activist campaign run by Nabi during his time at H Partners.

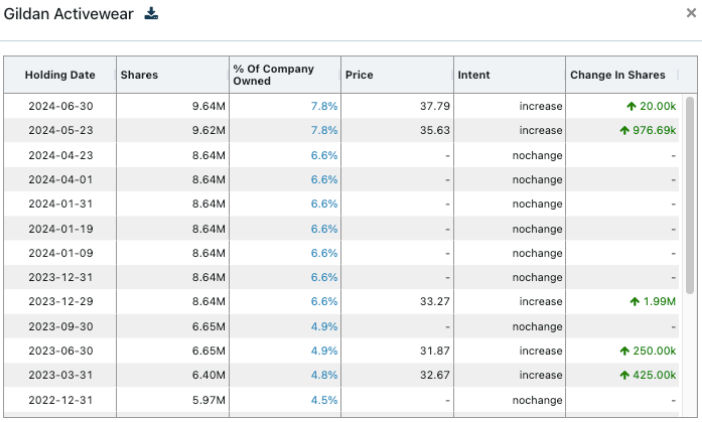

Browning West’s most recent activist campaign with Gildan Activewear is perhaps its most high profile & contentious. Though the firm first invested four years ago, its campaign picked up in earnest last December, when Gildan’s board fired longtime CEO Glen Chamandy in favor of an ex-Fruit of the Loom executive Vince Tyra.

Browning West wanted Chamandy back, and over the course of the next 6 months campaigned to oust the existing board and Tyra. Browning West bought roughly 3 million additional shares during this period:

In May, the efforts paid off: the entire board resigned, Tyra left, and Browning West handpicked 8 board members as their replacement while reinstalling Chamandy as CEO. With a nearly 8% ownership stake and the stock up over 46% year-to-date, OWL estimates that Gildan is Browning West’s most profitable investment this year.

“I think when we approach other public companies where change is required,” Nabi said , “folks are probably going to listen a little bit more carefully the next time.”

More recently, Browning West added to its position in the UK homebuilder Vistry Group yesterday, buying ~$10 million of shares after the company released a disappointing trading update. The last blue triangle represents the purchase made yesterday, October 10th, and is a great example of the timely international filings that OWL is often able to gather.

Recent Buys / Sells:

Moonlake ImmunoTherapeutics – BVF sold ~$100 million of stock on October 4th, roughly 10% of its stake.

C&D Property – Oceanlink trimmed its position in the Hong Kong-listed company on October 4th.

Scholar Rock Holding Corp — Samsara sold shares on October 7th following the company’s successful Phase 3 data (which caused the stock to more than triple), reducing their stake to 7% of the company.

RICOH – Effissimo continued buying shares in the Japanese electronics company on October 2nd, and now owns nearly 20% of shares outstanding.

Nalanda Positions – the India manager continued to gradually sell several names, with Q3 trims in V Guard, Thermax, and Havells disclosed last week.

Please reach out anytime with questions, comments, suggestions, or ideas!

-The OWL Team

About Old Well Labs (OWL)

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Please feel free to selectively share these updates with high-quality allocators who might be interested in learning more about the system.

Reach out to learn how OWL can help you find, monitor, and connect with fund managers globally