Dear OWL Users,

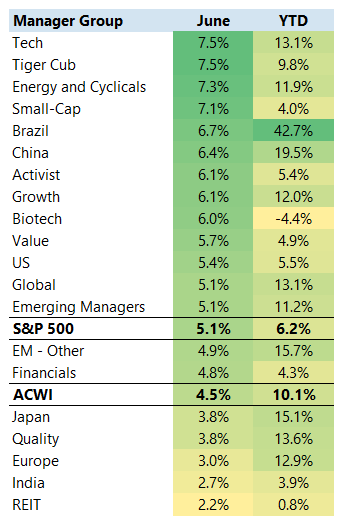

All OWL Groups had positive performance in June, with Tech and Tiger Cubs leading the way. Energy/Cyclicals, Small-Cap, and Brazil also had a strong month. Our Biotech group was up 6% in June but still has the lowest YTD performance across our groups. While still positive, Our India and REIT groups underperformed for the month.

As a reminder, the table below is based on our “OWL Groups” – curated lists of over 500 managers frequently found in leading allocators’ portfolios. These lists are categorized by geography, sector, and style, enabling our users to easily monitor groups of managers and their underlying disclosed holdings.

Source: OWL estimated returns of disclosed longs through 6/30/25

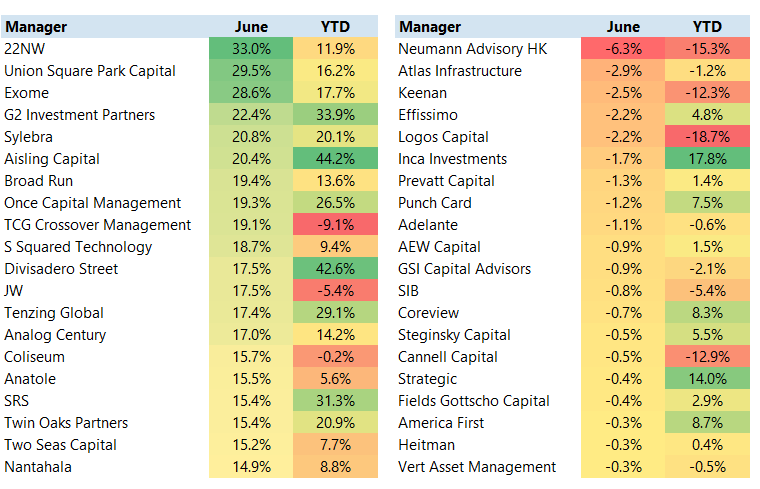

Below is a selection of managers whose disclosed positions had the best and worst estimated performance in June.

Source: OWL estimated returns of disclosed longs through 6/30/25

Seattle-based 22NW was founded in 2014 by Aron English after serving in research roles at Meson Capital and RBF Capital.

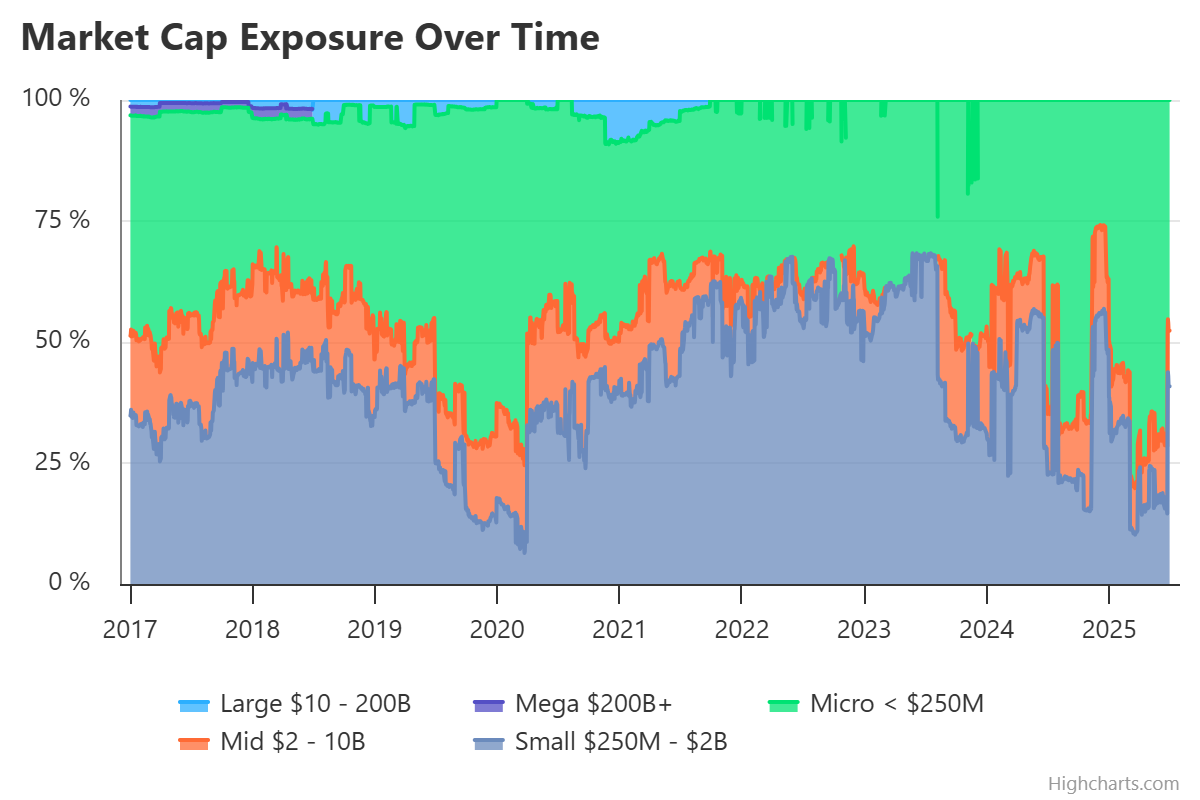

22NW currently discloses 23 positions, mostly in US microcaps. OWL users can look at exposures across several factors including market cap, sector, and geography for thousands of managers on our platform, helping them better understand portfolio and strategy shifts over time.

Source: Regulatory filings; OWL estimates

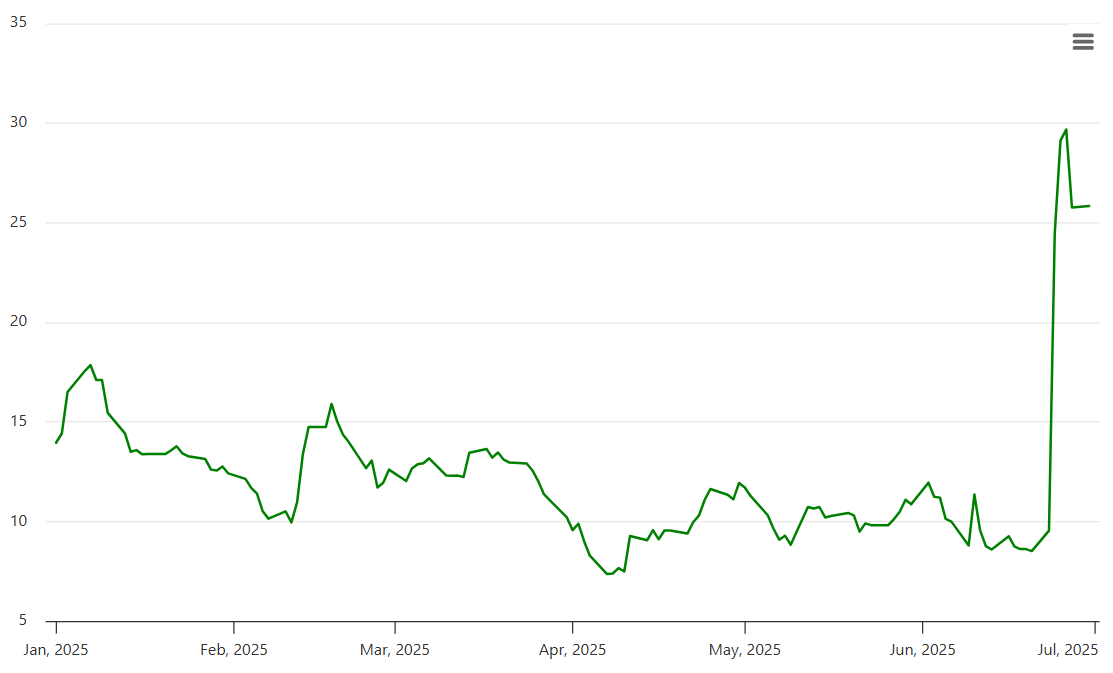

The primary driver of 22NW’s June performance was Nektar Therapeutics , a clinical-stage biotech company whose stock was up 100%+ in June after it announced positive trial results on June 24th. Following the run up in shares, Nektar also announced the pricing of a $100 million public stock offering on July 1st.

Nektar Therapeutics Stock Price

Nektar was also a key driver of June returns for several other managers on the list above, including Nantahala , TCG Crossover Management , Exome , and Union Square Park.

Beyond Nektar, which is 22NW’s largest disclosed position, several of the fund’s other large positions had a strong month in June, including LB Foster (+15%), Sterling Infrastructure (+22%), and Anebulo Pharmaceuticals (+35%).

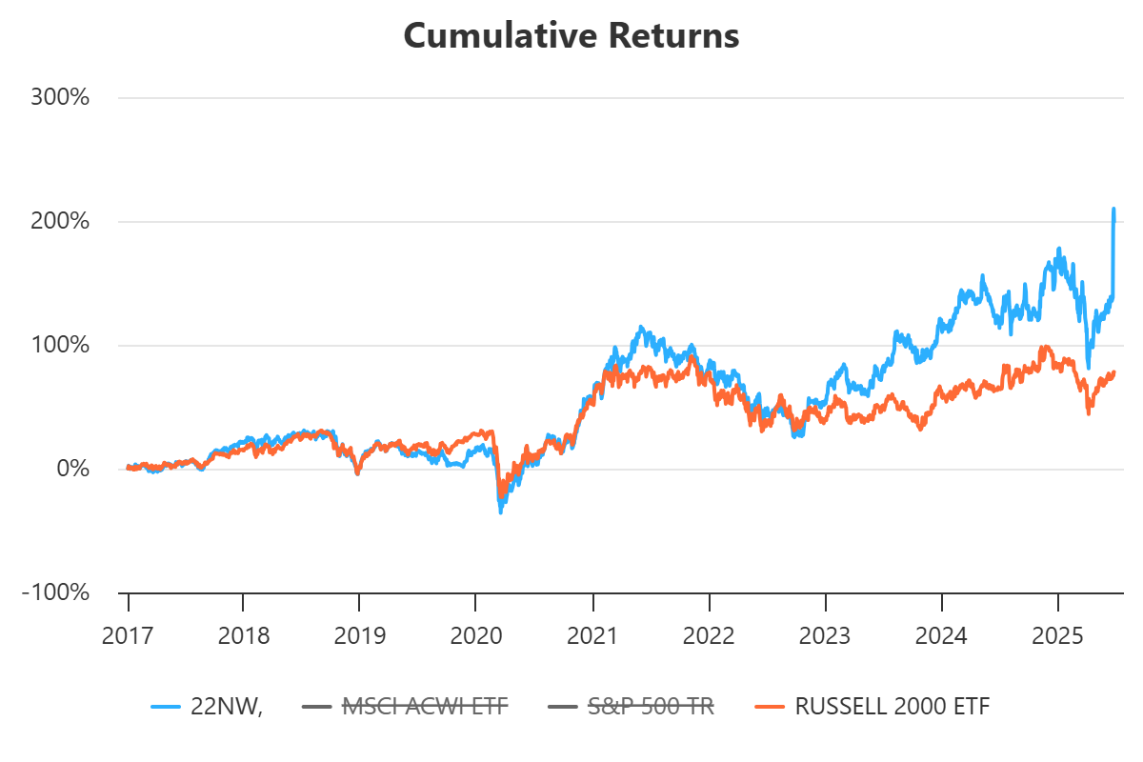

22NW began disclosing positions in 2017. Using OWL’s holdings data, we estimate that 22NW’s performance was roughly in line with the Russell 2000 between 2017-2022, and has significantly outperformed since then, with a large boost from this past month:

Source: Regulatory filings; OWL estimates

Recent Buys & Sells

Zymeworks : EcoR1 increased its position in the therapeutics company by 30% on 6/26. It now owns 33% of the company.

Cint Group – Ennismore decreased its short position in the Swedish software company to $5 million on 6/25

Sophia Genetics – Akre increased its ownership to 5.6% of the Switzerland-based medical software company on 6/20

Other News & Events

Featured Allocator | Maddie Wuelfing Rich of Berkeley Endowment Management Company

Featured Allocator | Christina Xing of the California Institute of Technology Investment Office

Featured Allocator | David Chiodo of Performance Equity Management

Featured Allocator | Christopher Goranov of the Cornell University Investment Office

Featured Allocator | David Tammaro of Pinegrove Venture Partners

Please reach out anytime with questions, comments, suggestions, or ideas!

-The OWL Team

About Old Well Labs (OWL)

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Please feel free to selectively share these updates with high-quality allocators who might be interested in learning more about the system.

Reach out to learn how OWL can help you find, monitor, and connect with fund managers globally