7.7.23

Dear OWL Users,

Happy 4th of July week! To commemorate, we analyzed the returns of over 4,000 stock pickers in the US over the past 20 years. Before we share those rankings, a quick recap of June performance is below.

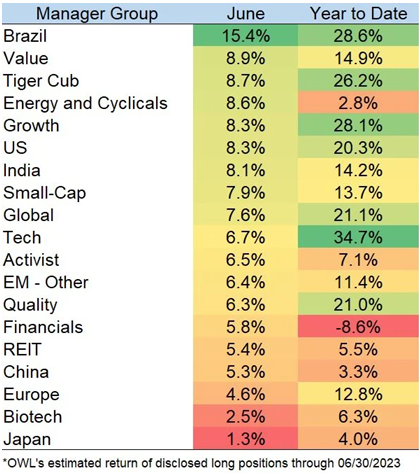

In June, all of OWL’s manager groups saw their disclosed positions appreciate, with managers focused on Brazil leading the pack. Biotech and Japan managers saw the smallest gains. As always, users can track all of this data, updated daily, in the OWL platform .

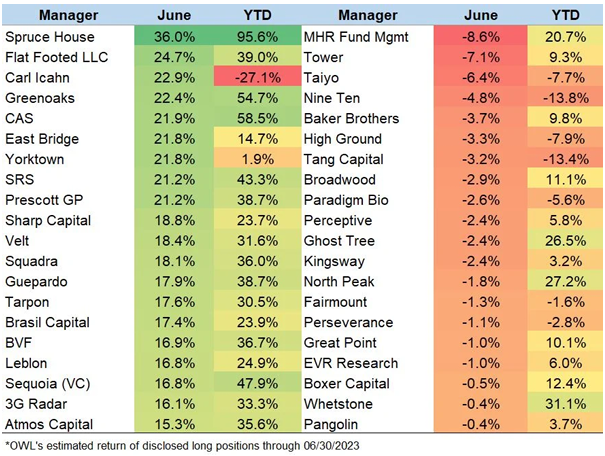

The table below shows a selection of the best and worst manager returns during the month, using OWL’s returns estimates. In addition to several Brazil managers making the list, holders of Carvana stock were rewarded during June, with the stock more than doubling. Three of the top five managers – Spruce House, Greenoaks, and CAS – have significant disclosed positions in Carvana and together own over 20% of the float.

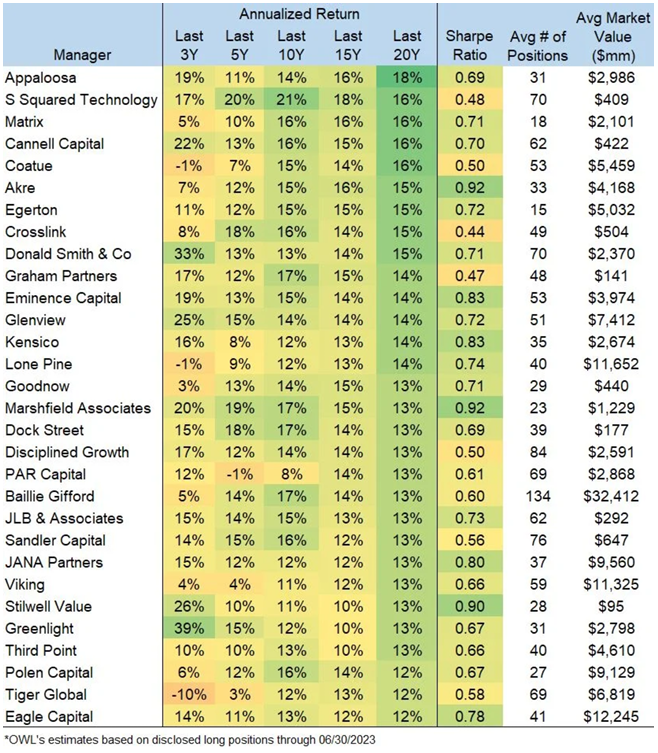

America’s Best Stock Pickers

The table below shows 30 of the most successful investors in the US over the past 20 years, according to OWL return estimates. For this analysis, we started with over 4,000 managers and excluded those without at least a 10-year track record of public disclosures. We also excluded managers with a minimal # of positions or asset size.

Congrats to David Tepper! While Appaloosa's disclosed public equities only represent a portion of Tepper's overall portfolio, the returns have been generated with a relatively high level of turnover (which can be tracked in OWL here ) and across various types of companies. For example, Appaloosa’s largest gains have included Alphabet, Goodyear Tire, HCA Healthcare, and Bank of America. The fund’s entire history, with profit broken out by stock, can be seen on the “P&L by Position” view in OWL.

As a Charlotte-based company, the OWL team hopes the next 20 years are just as successful for Tepper’s pro sports franchises!

The tie for the best Sharpe ratio goes to Akre Capital and Marshfield Associates . Akre is well known, and we’d recommend this “Invest like the Best” interview with Chuck Akre to anyone who hasn’t listened. Marshfield is a lesser-known firm (at least to us!) that owns a concentrated, low-turnover portfolio of positions in names like Arch Capital, Ross stores, and AutoZone.

The above is just one of many ways to analyze this group of managers using OWL data. Let us know if you’d like to see any other variations of the data set!

-The OWL Team

Please reach out anytime with questions, comments, suggestions, or ideas!

-The OWL Team

About Old Well Labs (OWL)

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Please feel free to selectively share these updates with high-quality allocators who might be interested in learning more about the system.

Reach out to learn how OWL can help you find, monitor, and connect with fund managers globally