2.9.24

Dear OWL Users,

This week, we’ll look at the investments at Jeremy Grantham’s two foundations, the Grantham Environmental Trust and the Grantham Foundation for the Protection of the Environment , which control $1.4 billion in combined assets.

Jeremy Grantham likely needs no introduction, but he is the co-founder of GMO and a renowned contrarian investor. Ramsay Ravenel oversees the operations of the foundations, which also paid $2.2 million to Cambridge Associates in 2022 for investment services, according to public filings.

Despite Grantham’s value-bent and (at times) bearish nature, a large percentage of the foundation portfolios are invested in venture capital. On the Invest Like The Best podcast in 2020, he stated that 60% of his foundation’s assets were invested in venture capital, with a target of 70%. In his words, "Even though I’m really quite down on American capitalism being a little fat and happy and past its prime, I am very long on American venture capital. It’s the really vital part of the capitalist model.""

Another of Grantham’s adventures in VC was documented in late 2020 in an FT article titled " Grantham stumbles on $200mm profit after Spac swoop on battery maker "

But seven years ago he personally invested $12.5m in QuantumScape, a Stanford University spinout, as part of a series of bets on early-stage "green" technology.

Mr Grantham stressed that he is a big believer in QuantumScape. But he is taken aback by his gains from investing in the company, which were supercharged since it announced in September that it would secure a slot on the New York Stock Exchange by merging with a special purpose acquisition company set up by Kensington Capital Partners, a US merchant bank that invests in the automotive industry.

"This is unlike anything else in my career. This was by accident the single biggest investment I have ever made,"" he told the Financial Times. "It gets around the idea of listing requirements, so it is net a useful tool for a lot of successful companies. But I think it is a reprehensible instrument, and very very speculative by definition."

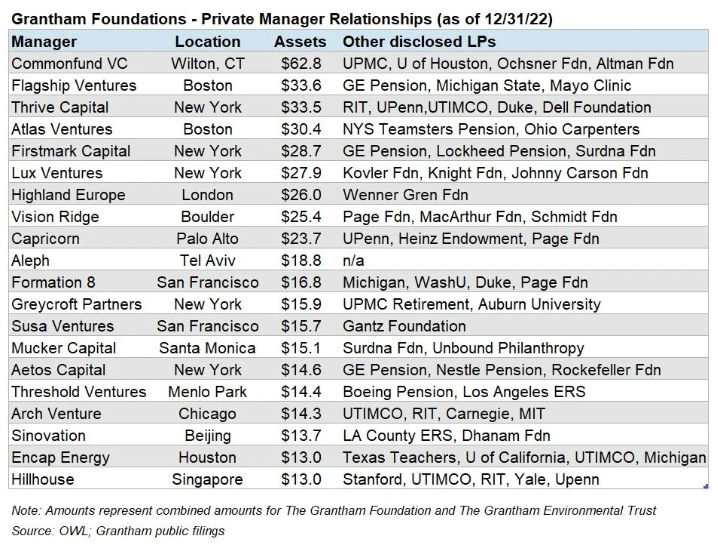

The table below shows a selection of the largest manager relationships for Grantham's foundations. OWL users can see the entire list, including a handful of public managers, using the links above.

One of Grantham’s largest VC investments is with Thrive Capital , a firm founded by Joshua Kushner in 2010. While Josh may be the lesser-known of the Kushner brothers, Thrive has been in the news recently due to its investment in OpenAI. Beyond its VC investments, Thrive began disclosing public equity positions in 2019, with current positions including Robinhood, Carvana, Oscar Health, and Maplebear (Instacart).

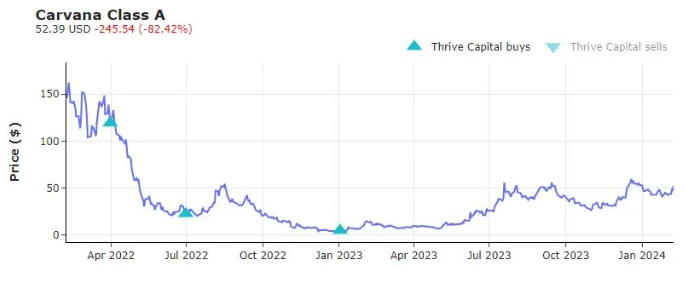

While several of Thrive’s public equity positions are in companies they invested in pre-IPO, they bought shares of Carvana in the open market beginning in Q1 2022, adding to it’s position after the stock fell over 90%. Despite the wild ride, OWL estimates that Thrive has now made a small profit on its Carvana position:

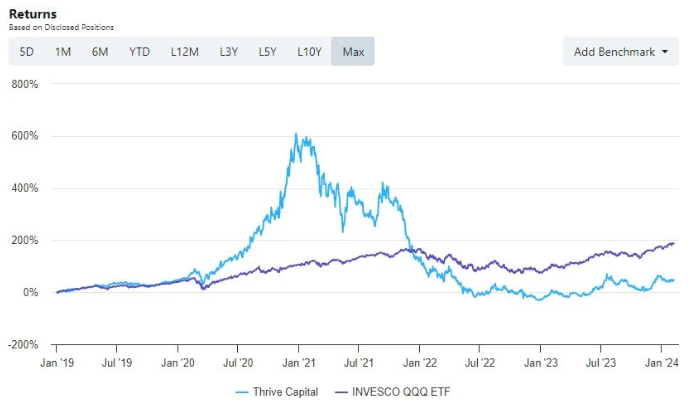

The returns of Thrive’s handful of public equities have been volatile, to say the least. The chart below, from OWL’s manager homepage, also includes a new feature added this week, which is the ability for users to add and change benchmarks for any manager – in this case, we changed the benchmark for Thrive to the QQQ ETF:

Thrive has an impressive list of disclosed LPs, which OWL users can see in our allocator database . In addition to Grantham, some of Thrive’s LPs include Duke , UPenn , UTIMCO , Hillman , RIT , Kaiser Permanente , and the Dell Foundation . The additional data in OWL includes specific amounts invested and fund-level detail.

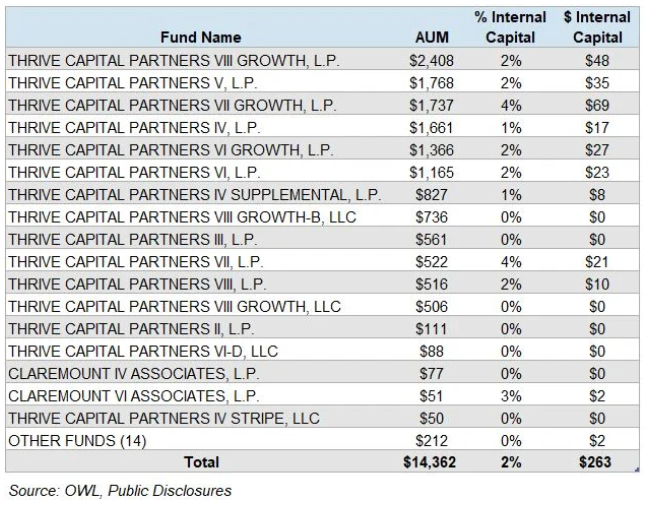

Fund-level data is an area of focus for our team, and we will be adding new features around this in the coming weeks. For example, OWL users will be able to see each vehicle that a manager controls, its AUM over time, and the percent of each fund’s assets that are from firm employees. The table below shows this information for Thrive:

Recent Buys/Sells

Magenta Therapeutics – RA Capital opened a position on 1/25 and owns 20% of the company; we noted in last week’s Insights that Fairmount had opened an 18% position

Tyra Biosciences - RA Capital filed a 13D on 2/6, increasing its position to 20% via a negotiated PIPE with the company; Boxer Capital also participated

Tomra Systems - Parvus opened a 0.5% short position in the Norwegian sensor company on 1/17

Elekta – Gladstone increased its short position in the Swedish healthcare company on 2/8

Fuji Media - Dalton increased its position in the Japanese broadcasting and tourism company on 2/1 and now owns 6.2% of the company.

Please reach out anytime with questions, comments, suggestions, or ideas!

-The OWL Team

About Old Well Labs (OWL)

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Please feel free to selectively share these updates with high-quality allocators who might be interested in learning more about the system.

Reach out to learn how OWL can help you find, monitor, and connect with fund managers globally