10.13.23

Dear OWL Users,

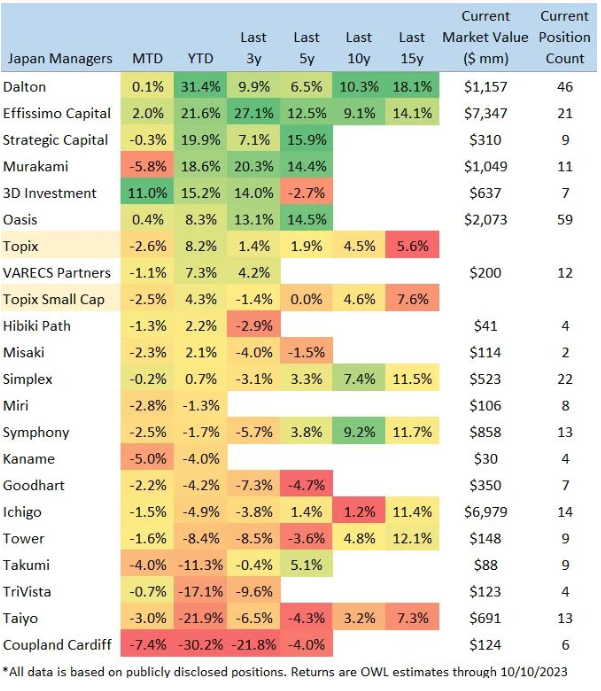

This week, we'll highlight managers in OWL's Japan Group. As always, please let us know if we're missing any that should be included!

Japanese disclosures are especially rich for activist managers, and Japanese regulators are spurring these activists to make a record number of shareholder proposals. This year's worst performers are managers that are overweight tech, like Coupland Cardiff (now Chikara ) and Takumi . The top performers are long-tenured funds such as Dalton and Effissimo.

Murakami Mayhem

Effissimo is one of several managers near the top of the performance table with ties to Yoshiaki Murakami. In 2007, Murakami, the founder of MAC Asset Management, was sentenced to two years in prison in an insider trading case. He has since launched a family office and continued a (mostly) hostile activist strategy with over $1 billion of disclosed positions. According to OWL estimates, Murakami's family office has earned positive P&L in eight of the past ten years, with over $1 billion in overall profits since his return.

Since the dissolution of MAC, Murakami team members have launched two funds with a similar activist approach. Effissimo Capital is now one of Japan's most prominent activist funds, with an estimated $7+ billion of profits since inception and significant gains from companies such as Kawasaki Kisen, Dai-Ichi Life, and Toshiba. The other Murakami spinout, Strategic Capital , is very willing to go public with their demands and has the best 5-year return of any OWL Japan manager, according to OWL estimates.

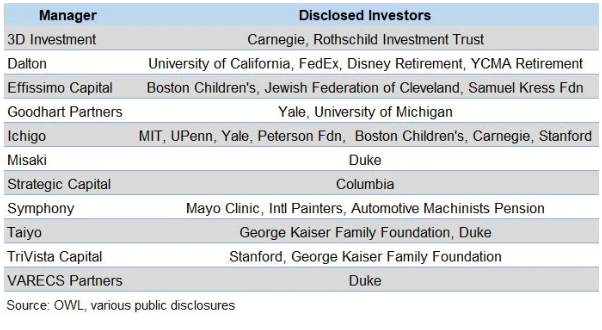

Allocator Positions in Japan

We have recently heard of much interest in Japan from US endowments and foundations. The table below shows a selection of disclosed positions in Japanese managers. OWL users can track these and many more in OWL’s allocator database.

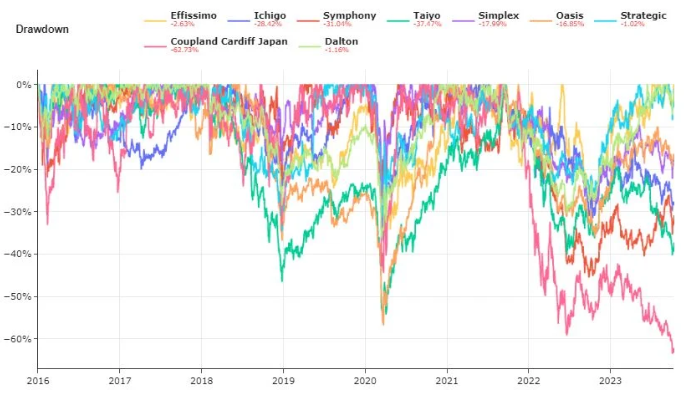

Recent Dispersion

Dispersion amongst managers in Japan has increased over the past two years. One way to analyze this in OWL is using the Report Builder , where we can look at peak-to-trough drawdowns for a group of managers over time.

While Dalton and Effissimo are currently at a peak, several managers, such as Taiyo and Coupland Cardiff, remain in meaningful drawdowns.

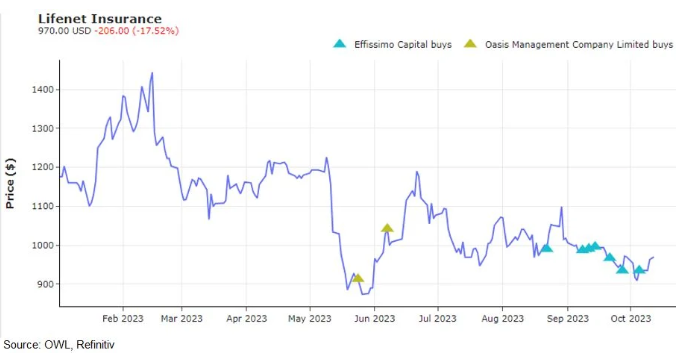

Timely Disclosures

According to Japanese regulations, large shareholders must publicly disclose trades within five business days of crossing certain ownership thresholds. One recent example is Lifenet Insurance, an online life insurance provider that both Oasis and Effissimo have been acquiring in recent months. The two managers combined own over 27% of the company today.

While writing this update, a new filing came out disclosing that Effissimo increased its stake further after purchasing additional shares on Oct 5th (last Thursday).

Please reach out anytime with questions, comments, suggestions, or ideas!

-The OWL Team

About Old Well Labs (OWL)

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Please feel free to selectively share these updates with high-quality allocators who might be interested in learning more about the system.

Reach out to learn how OWL can help you find, monitor, and connect with fund managers globally