1.31.25

Dear OWL Users,

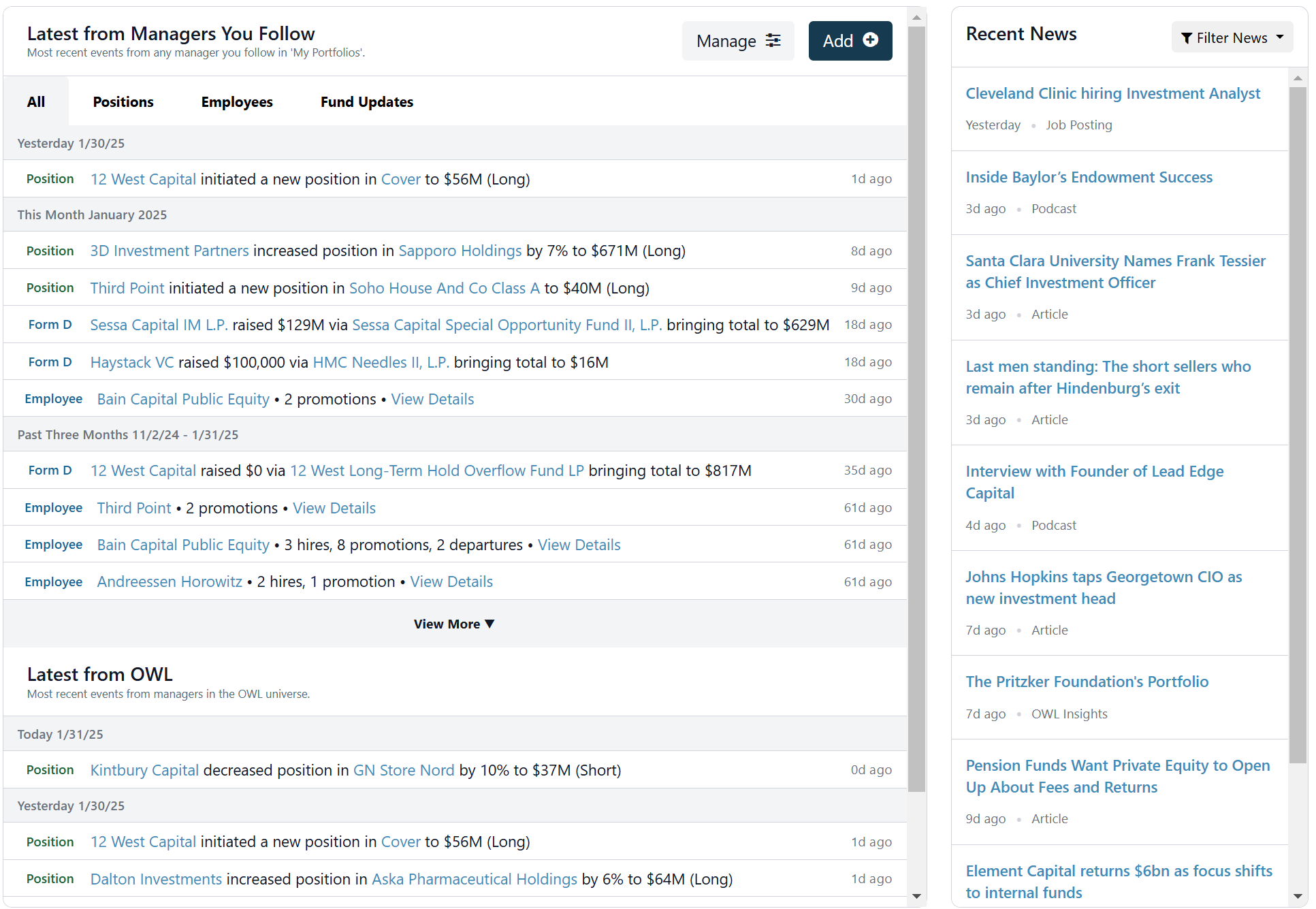

Before we dive into the January recap, we have an exciting product update to share. This morning, we launched a brand-new landing page designed to make tracking the managers you care about even easier.

Now, when you log in to OWL , you'll see a personalized feed featuring updates for the managers you follow in your "My Portfolios." If you haven’t set up a My Portfolio yet, we highly recommend doing so - you’ll get a customized experience and start receiving weekly email updates for the managers that matter most to you.

Adding managers is simple: just click the "Add" button to include them in your "Watchlist", which serves as the default portfolio for all users:

Your new feed will surface key updates, including:

✅ Stock transactions✅ Team changes

✅ Fund updates

OWL tracks over 12,000 managers of all types, and in the coming months, we’ll be adding even more data and functionality to this feed, including the ability to follow allocators and track their investments and team changes.

If you prefer the previous dashboard showing public equity manager performance, don’t worry - it’s still available under "Dashboard" in the OWL Portfolios section of the left navigation.

We’d love to hear your feedback—let us know what you think!

January 2025 Recap

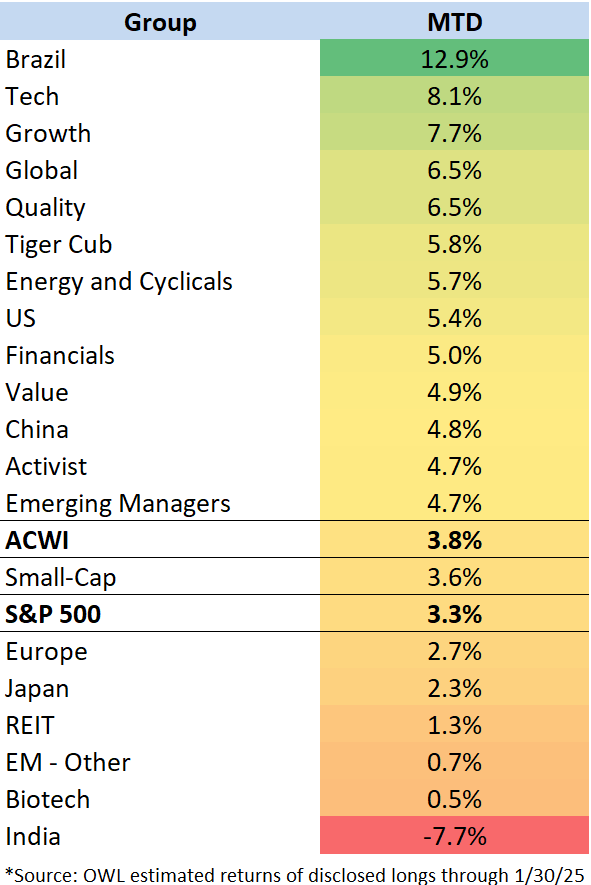

As of yesterday, Brazil, Tech, and Growth-focused funds have led the way this month, while India, Biotech, and most international markets (except Brazil) have underperformed:

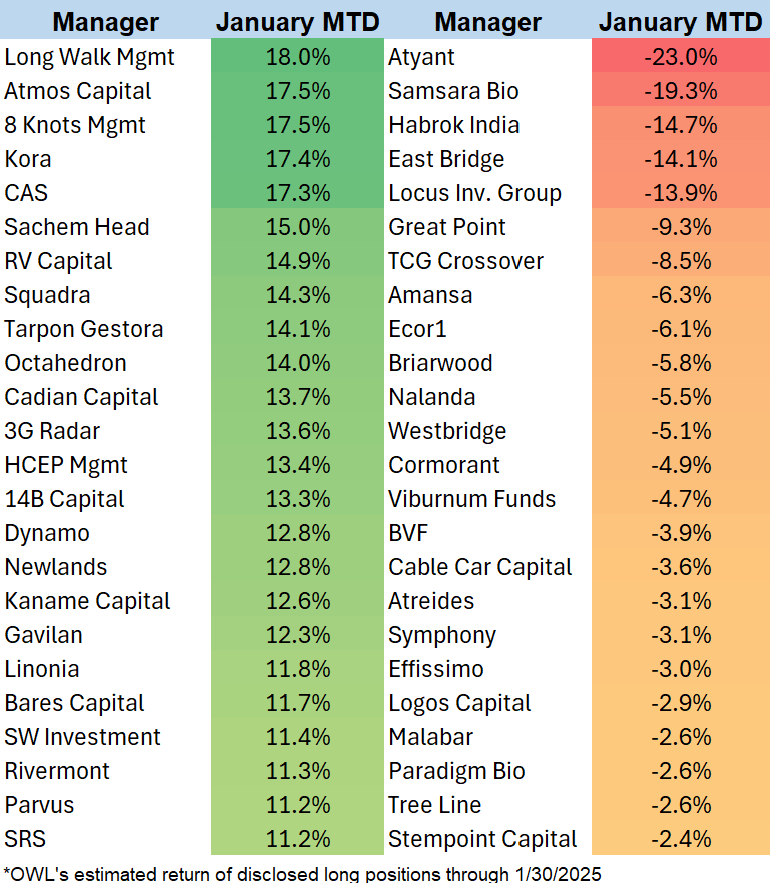

Below is a selection of managers whose disclosed positions have had the best and worst performance month-to-date. Several tech-focused managers (Long Walk, Kora, CAS, Octahedron) and Brazil-based funds (Atmos, Squadra, Tarpon, 3G Radar) were among the top performers, while the worst performers were primarily India- and Biotech-focused funds.

One standout performer this month is Newlands , the family office of Jan Koum, the founder of WhatsApp. In 2021, Koum began hiring a small team—including Michael Abramson and several Sequoia alums who first connected with him when Sequoia invested in WhatsApp.

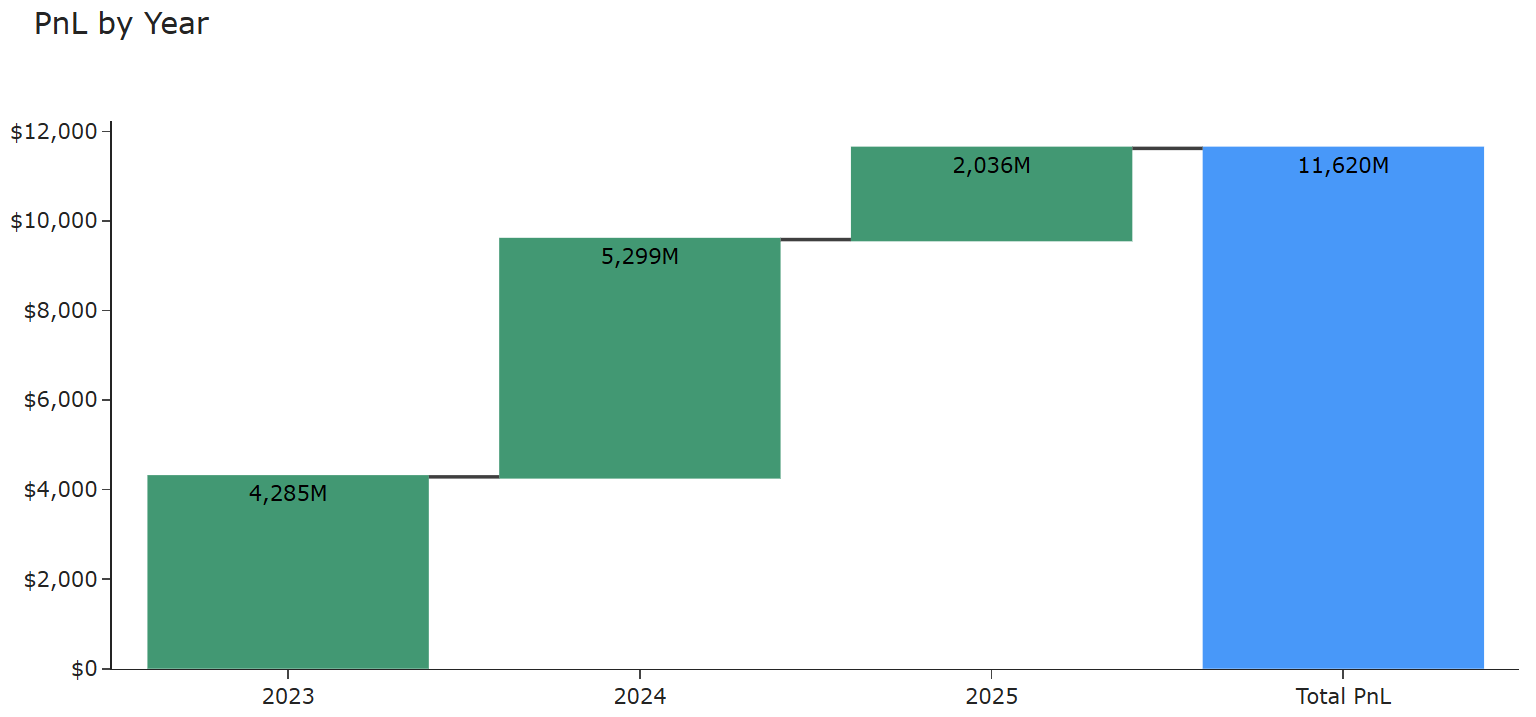

Today, Newlands manages a disclosed public equity portfolio worth nearly $18 billion, with billion-dollar-plus positions in Meta, Amazon, Tesla, DoorDash, Robinhood, and Alphabet. OWL estimates that two-thirds of this $18 billion stems from gains over the past few years, with over $5 billion in profit from Meta alone:

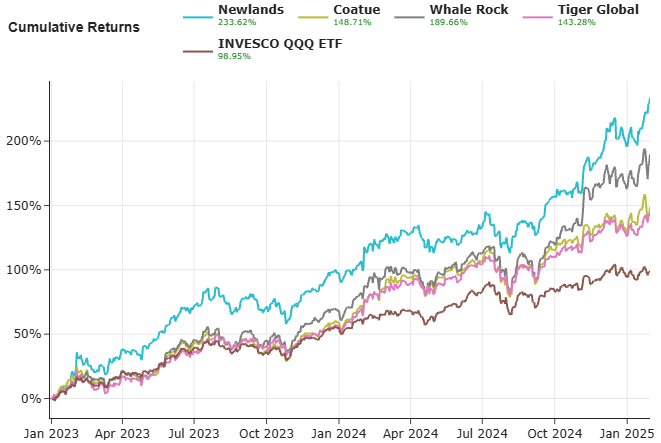

While most tech-focused managers have benefited from the post-2022 market environment, Newlands' disclosed long positions have outperformed both well-known tech funds and the Nasdaq - despite not owning Nvidia:

Beyond these public investments, little is known about Newlands. A Forbes article from last year (preview available here ) offers some insight. Koum also oversees a foundation with $2.3 billion in assets (as of YE 2023), which lists Newlands as an affiliated entity. The foundation’s filings reveal minority investments in 31 private companies and 9 private equity funds.

Recent Buys / Sells:

Cover Corp – 12 West recently bought a 5.1% stake in the Japanese video content company. The position was disclosed on January 30th after the fund purchased shares as recently as January 23rd.

Voltamp Transformers – Nalanda continued it’s consistent trimming of positions in recent months, selling a portion of its Voltamp position on January 24th.

Soho House – Third Point disclosed a 9.9% stake on January 22nd, urging the global membership company to follow a fair sales process after an acquisition offer was made late last year.

Alpha Systems – Simplex added to its long held position in the Japanese IT company, which it has owned since 2016. The fund now owns over 15% of the company, which is its 2nd largest disclosed position.

Avanza Bank – Hound Partners trimmed its short position in the Swedish bank several times in January, most recently on January 27th.

Other News / Events:

GEM announces Matt Bank as next CIO

Cleveland Clinic hiring Investment Analyst

Interview with Baylor’s Investment Team

Santa Clara names new CIO

FT article on short sellers

Podcast with founder of Lead Edge Capital

Johns Hopkins hires Mike Barry at new CIO

Bloomberg article on large hedge funds returning capital

Please reach out anytime with questions, comments, suggestions, or ideas!

-The OWL Team

About Old Well Labs (OWL)

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Please feel free to selectively share these updates with high-quality allocators who might be interested in learning more about the system.

Reach out to learn how OWL can help you find, monitor, and connect with fund managers globally