11.15.24

Dear OWL Users,

This week we’ll look at Columbia University’s $14.8 billion endowment , which is managed by the Columbia Investment Management Company.

The endowment is run by CIO Kim Lew, who joined in November 2020 after serving as the CIO at the Carnegie Corporation of New York, which we wrote about in last week’s newsletter . Prior to that, she worked at the Ford Foundation, where she spent more than a decade.

Columbia’s Fiscal Year 2024 return of 11.5% is the highest for an Ivy League endowment for the second year running. Explaining the performance, Lew noted , “Fiscal 2024 was a strong year for public market performance. We benefitted both from our exposure to public markets and from strong performance of individual managers relative to benchmarks... While private assets lagged our marketable assets portfolio, it contributed positive performance in the past year.”

Despite strong recent performance, Columbia has trailed many of its Ivy League peers over longer periods, with 10-year trailing returns of 7.4%. OWL users can see full details on our Endowment Performance Tracker.

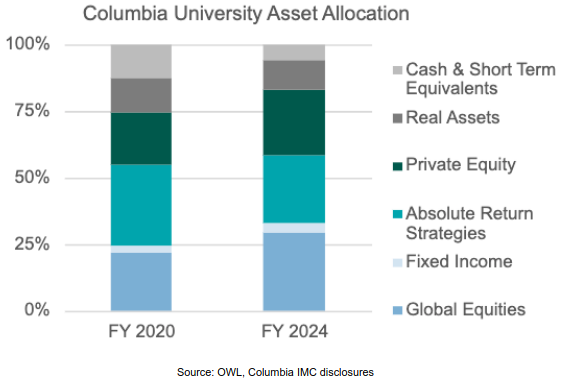

In the four years since Lew took over, the portfolio has shifted more toward global equities and private equity, while holdings in real assets, absolute return, and cash have decreased:

Disclosures for endowments vary by school – while we’ve highlighted many institutions in prior issues with comprehensive disclosures, Columbia only discloses a handful of its manager investments. A few of these disclosed in recent years include Dynamo , Star Asia , Canaan Partners , Deccan , Jinge Asset Management , Calunius Capital , and Altos Ventures .

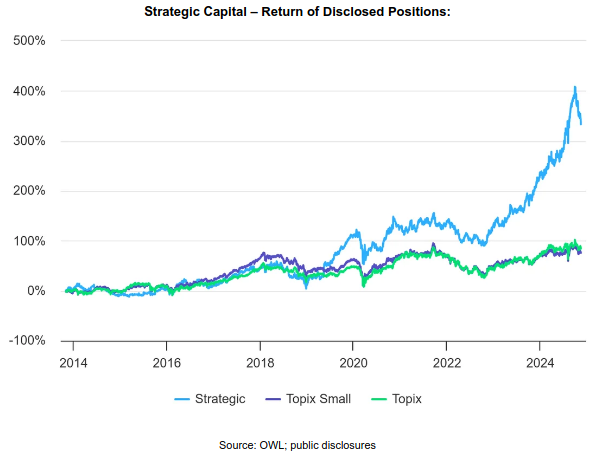

Another of Columbia’s disclosed investments is with Strategic Capital , a Tokyo-based activist fund founded in 2012 by Tsuyoshi Maruki. Maruki started his career at Nomura Securities, after which he helped launch M&A Consulting (later MAC Asset Management). In 1999 he helped start the Murakami fund, which we profiled last year . Based on OWL performance estimates, Strategic has materially outperformed Japanese indices over the last 10 years.

Strategic’s investment approach is characterized by its focus on “companies with poor governance and management that are resistant to change,” where they accumulate significant stakes and push for changes via shareholder proposals and board nominations.

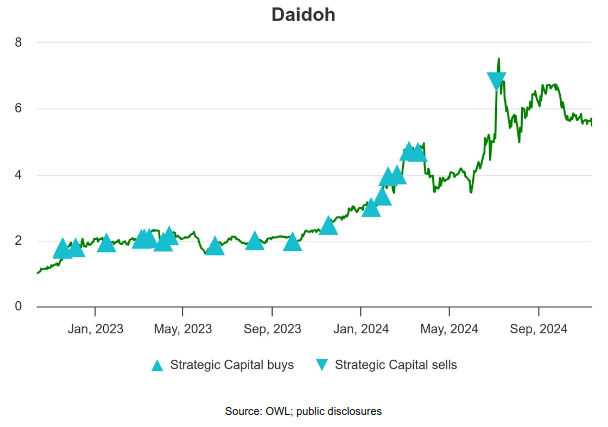

A recent example was Daidoh, a small-cap Japanese clothing company, where earlier this year Strategic nominated six directors for the board. This move came after a year and a half of unsuccessful attempts to engage with Daidoh's management on governance improvements and resulted in Strategic securing three board seats.

Strategic first disclosed a position in Daidoh in November 2022 and exited their position completely in July following the success of their campaign. OWL estimates the firm netted roughly $40 million in profit, a gain of nearly 200%.

Strategic also took advantage of the recent market downturn in Japan, which we noted in August , adding to positions in Toa Road, Yodogawa Steelworks, and Yellow Hat. As a reminder, OWL users now receive timely email alerts for these types of filings, making it easy to monitor global disclosures for more than 12,000 managers in OWL.

A good example of this is Strategic’s largest position, Yellow Hat . Strategic began acquiring shares in July 2024 and has been adding steadily since, most recently on October 15th. Strategic now owns nearly 12% of the software company but has not written or made any public statements about its investment to date.

Recent Buys / Sells:

Mercari – Oasis disclosed a 5.4% stake in the Japanese e-commerce company on November 6th.

Avanza Bank – Kintbury continued shorting the Swedish online bank on November 11th, bringing their short position to over 1% of shares outstanding.

Kawasaki Kisen – Effissimo trimmed its position on November 7th. The fund has owned a stake in the Japanese shipping company since 2015, and still owns a position worth over $3 billion.

Valmet – Perbak Capital initiated a short in the Finland-based pulp and paper company on November 12th. Capeview, Kintbury, and AKO are also short the stock.

Other News & Events:

FT article, featuring OWL, on endowment struggles with private assets.

U of Nebraska returns 14.5% for FY.

Lehigh returns 10.5% for FY.

Wellesley College returns 7.8% for FY.

Trinity University is hiring an investment manager for privates.

The Kresge Foundation is hiring a Associate Investment Director.

UTIMCO is hiring a senior investment analyst for public equity.

II article on strong biotech fund performance in October.

Conversation between Stan Druckenmiller and Nicolai Tangen.

Please reach out anytime with questions, comments, suggestions, or ideas!

-The OWL Team

About Old Well Labs (OWL)

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Please feel free to selectively share these updates with high-quality allocators who might be interested in learning more about the system.

Reach out to learn how OWL can help you find, monitor, and connect with fund managers globally