3.15.24

Dear OWL Users,

This week, we’ll do a deep dive into the portfolio of the Carnegie Corporation of New York , a $4 billion foundation established by Andrew Carnegie in 1911. To quote the foundation directly, “Carnegie dedicated his foundation to the goal of doing ‘real and permanent good in this world’ and deemed that its efforts should create ‘ladders on which the aspiring can rise.’” The foundation’s grants focus on Education, Democracy, International Peace and Security, and Higher Education and Research in Africa. The foundation has supported a range of programs from creating Sesame Street to dismantling nuclear weapons.

Andrew Carnegie, the industrialist and steel magnate of the late 1800’s, sold Carnegie Steel Company to J.P. Morgan in 1901 for $303 million (equivalent to more than $10 billion today). He popularized the idea of giving away the majority of his fortune while living in his famous essay The Gospel of Wealth , something Warren Buffett and other contemporary billionaires have continued with The Giving Pledge.

In addition to the Carnegie Corporation of New York, Andrew Carnegie made significant contributions to the Carnegie UK Trust, Carnegie Endowment for International Peace, Carnegie Institute for Science, and many others.

The Carnegie Corporation of New York’s portfolio looks fairly similar to some of the well-known U.S. endowments. Jon-Michael Consalvo is the recently appointed CIO, taking the post in February 2024 after starting with the organization as an analyst in 2009.

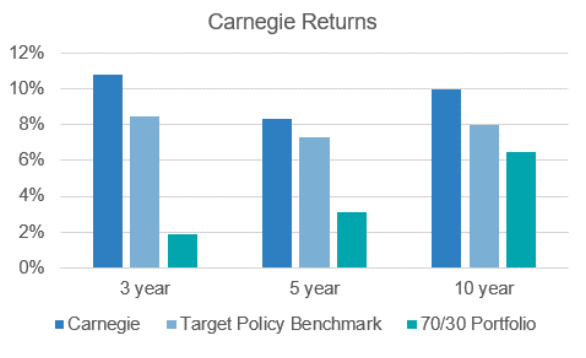

Unlike many foundations, Carnegie discloses returns on an annual basis, and has outperformed its benchmarks in recent years:

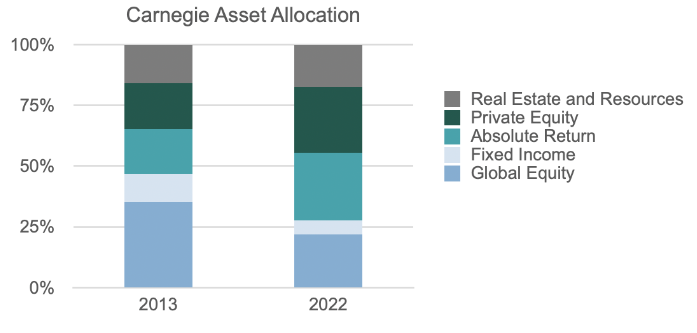

Like many of its endowment peers, Carnegie’s asset allocation has shifted over time towards private equity and absolute return strategies:

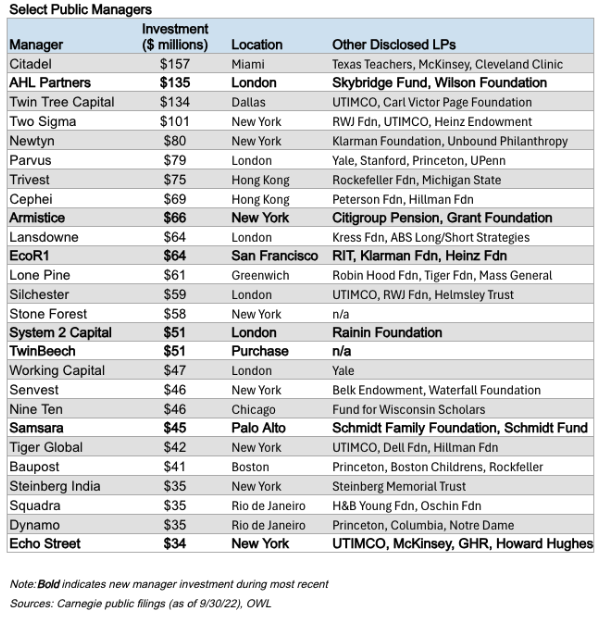

The chart below shows a selection of Carnegie’s largest public managers, a mix of quantitative/multi-manager platforms and fundamental managers. OWL users can access the complete list here:

Carnegie added several new managers in 2022, including EcoR1 , a San Francisco-based Biotech manager. While the biotech sector has had a volatile few years, OWL’s Biotech Group (a curated selection of well-known biotech managers) is up 12.5% YTD, the highest-performing group across the OWL platform this year.

EcoR1 was founded by Oleg Nodelman in 2013 following several years at BVF Partners, one of the first biotech-focused investment funds.

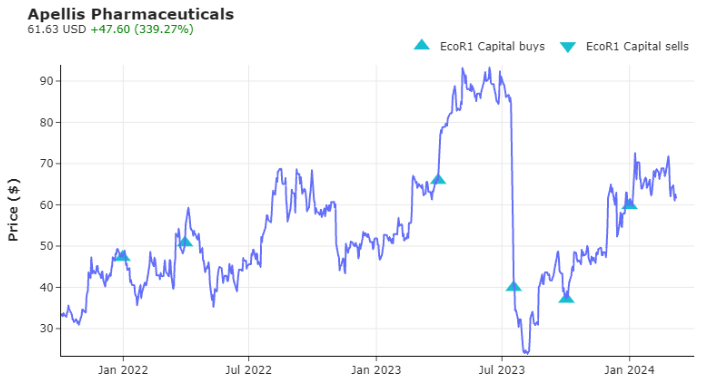

Biotech filings are often very timely as funds in the sector frequently take large positions in smaller companies, triggering disclosures such as 13D, 13G, and Form 4 filings. One example is EcoR1’s position in Apellis Pharmaceuticals , which they first disclosed in 2022 via a quarterly 13F filing. In July of 2023, the stock dropped significantly when the company disclosed potential issues with Syfovre, one of its drug candidates. The following day, EcoR1 filed a 13G disclosing an increase of its position above 5.1%, and as of 12/31/23, owns 9.4% of the company (whose stock price has somewhat recovered):

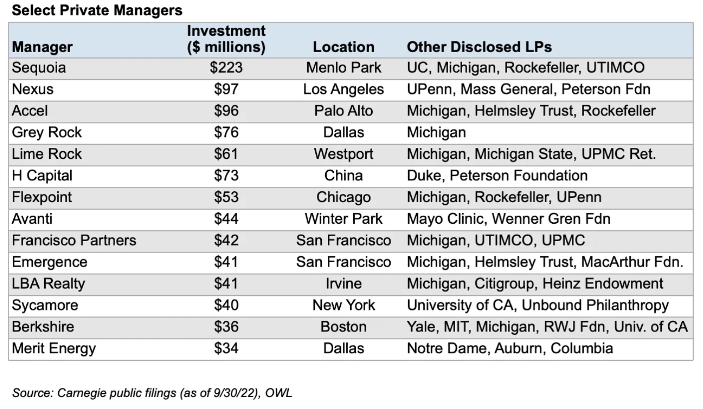

The table below shows a selection of Carnegie’s private manager relationships - our users can find full details in OWL here:

Recent Buys/Sells

Corbus Pharmaceuticals – Cormorant Capital continued adding to its stake on March 7th and 8th and now owns over 14% of the company.

Freee Kk – Kora Management disclosed a 5% stake in the Japanese tech business focused on accounting software. Kora bought shares as recently as March 4th.

Oro Co Ltd – VARECS Partners disclosed 5% ownership in the Japanese cloud and digital transformation company, buying as recently as March 4th.

Embracer Group – Gladstone added to their short on March 7th, a week before the company announced a divestment of select assets.

Lumine Group – Blacksheep slightly trimmed its position in the Canadian listed software business, decreasing the fund’s stake to just under 10% of the company. Blacksheep’s position has more than doubled in value since it was first disclosed last year.

Please reach out anytime with questions, comments, suggestions, or ideas!

-The OWL Team

About Old Well Labs (OWL)

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Please feel free to selectively share these updates with high-quality allocators who might be interested in learning more about the system.

Reach out to learn how OWL can help you find, monitor, and connect with fund managers globally