11.8.24

Dear OWL Users,

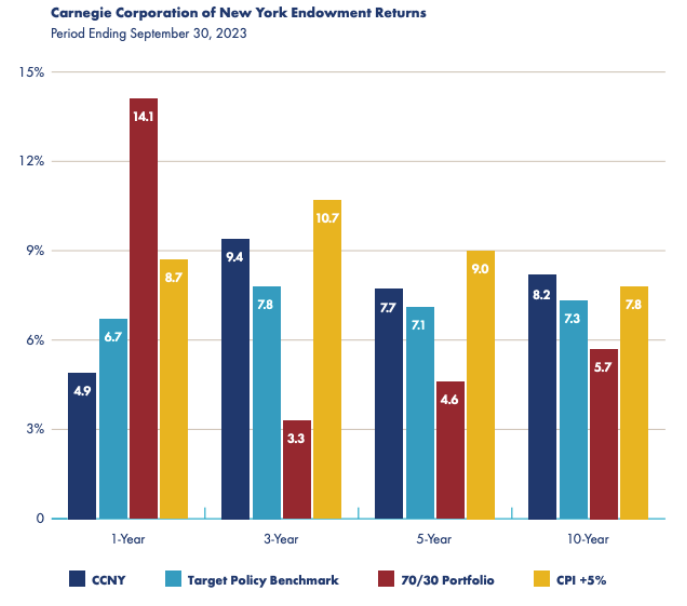

This week, we’ll look at recent filings from the Carnegie Corporation and highlight several new allocations made by the investment office. The foundation, which we wrote about earlier this spring , returned 4.9% for the fiscal year ending 9/30/23 and stands at $4.1 billion in assets. OWL users can see full portfolio details on Carnegie’s profile.

Earlier this year, Carnegie appointed a new CIO, Jon-Michael Consalvo , to lead the foundation. Consalvo, a 15-year veteran of the institution, was promoted from his previous role as managing director. His appointment follows the departure of Mark Baumgartner, who stepped down in September 2023 to become CIO of the Dalio Family Office, and most recently joined as CIO of UFICO.

Unlike many foundations, Carnegie discloses its returns on an annual basis. Though the foundation’s long-term results have beaten its benchmarks, last year’s returns were weighed down by the underperformance of private equity, real estate, and other private holdings. Carnegie noted that its public equity portfolio was up 18.2% for FY23, while private equity was down 2.8% and private diversifiers were down 1.0%.

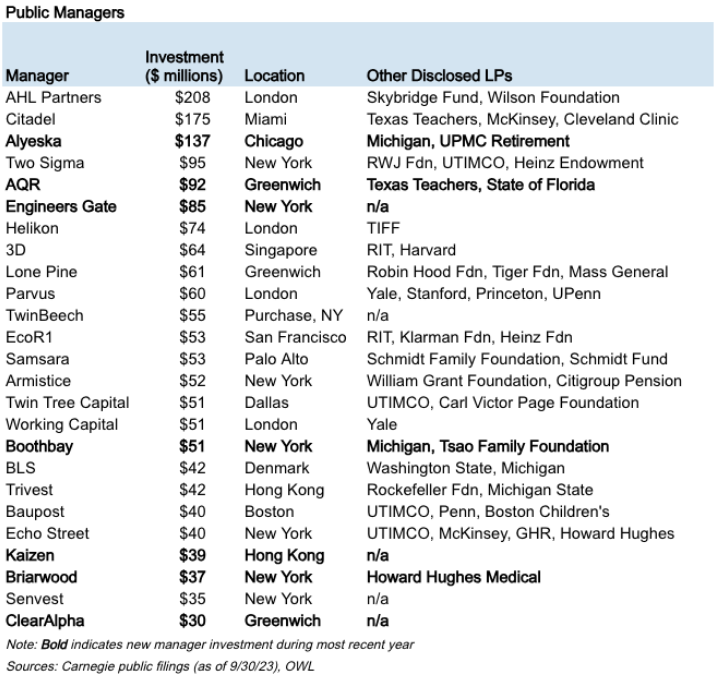

This year, a noteworthy theme in Carnegie’s investments was the shift into more quantitative & multi-manager strategies. The largest new investment was in the Aleutian Fund, managed by Alyeska . AQR , Boothbay , AFBI, John Street, and Engineers Gate were other new investments made by Carnegie in the last year. Of the capital deployed to new funds in FY23, we estimate that more than 50% (~$390 million) went to these types of strategies. Carnegie appears to have redeemed substantial amounts from other managers, including Lansdowne , Twin Tree , Squadra , Newtyn , and Silchester.

The chart below shows a selection of Carnegie’s largest public managers. OWL users can access the complete list here:

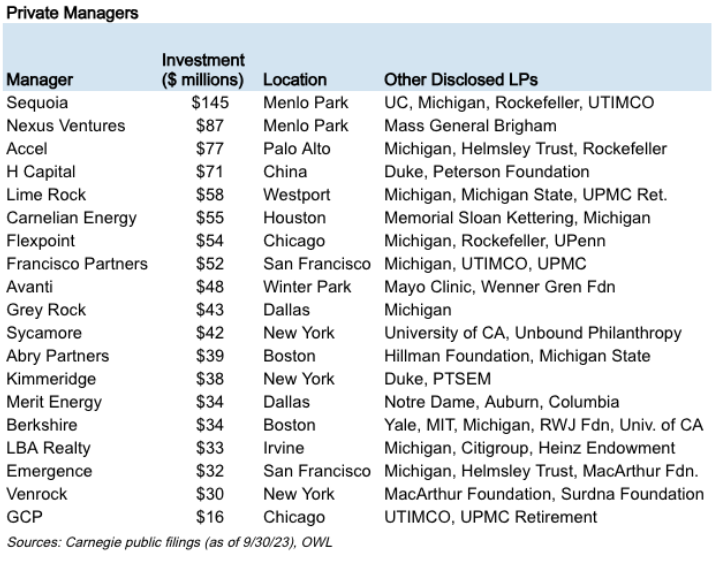

In its private portfolio, Carnegie didn’t disclose any significant new manager relationships during the FY but did invest in several new funds launched by existing managers. Several new funds in the energy space appeared this year for the first time, including $22 million into Kimmeridge’s Energy Engagement Partners II, $12 million into Carnelian’s Ridgemar Co-Invest, and $6 million into Energy Capital Partners VB. Other notable new private investments include GCP’s Fund III, EMG Fund II, and Nexus Ventures VII.

A selection of Carnegie’s private relationships is below, and OWL users can see full fund-level details on Carnegie's profile page.

Briarwood Chase

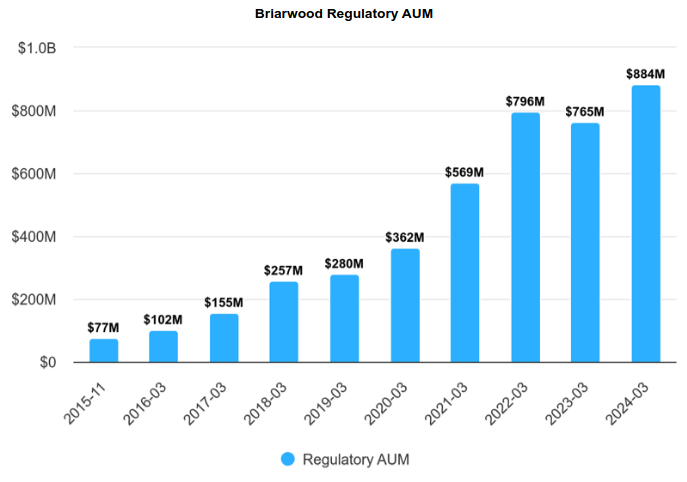

One of Carnegie’s new public manager investments is Briarwood Chase Management (BCM). Briarwood, founded by Aalap Mahadevia, invests in global small and mid-cap companies. Before founding Briarwood, Mahadevia was an investor at Tiger Management and Farallon Capital.

Briarwood was reportedly the first hedge fund investment for the Winklevoss twins’ family office and initially operated out of their NY offices. Mahadevia also co-founded the investor network SumZero with Divya Narendra, famous for joining the Winklevoss twins in their lawsuit over the founding of Facebook.

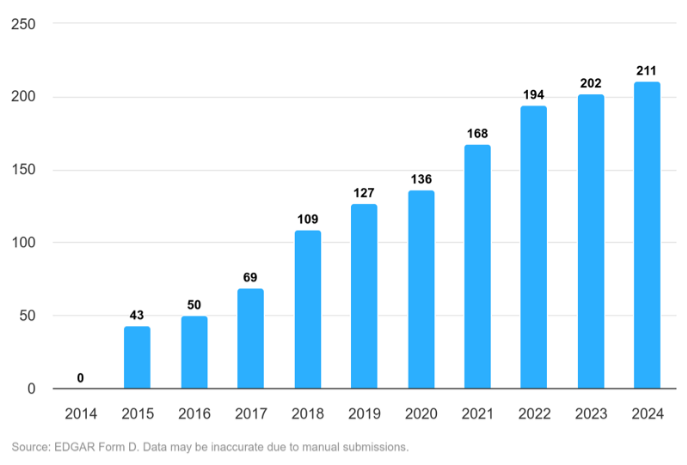

Briarwood also counts Howard Hughes Medical Institute as a notable LP and has steadily raised new capital since its 2014 launch:

In OWL’s new fund-level view, our users can see the # of LPs that have invested in each entity controlled by the manager. For example, here is the # for Briarwood Capital Partners LP, the vehicle that controls the majority of BCM’s assets:

Number of Briarwood Capital Partners LPs

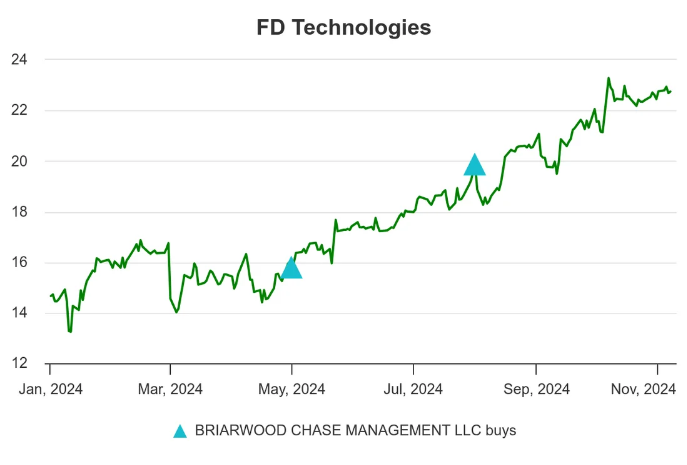

One of Briarwood’s largest disclosed positions is in FD Technologies, the British software & consulting business. Briarwood first disclosed a position this past Spring and now owns over 9% of the company.

Briarwood was involved in supporting a recent vote to divest the company’s First Derivatives Business, allowing FD Technologies to return excess cash to shareholders and focus on its core KX vector database business. Along with Irenic , the two firms own nearly 30% of shares outstanding. Other managers invested in FD include Gumshoe and Newtyn.

Recent Buys / Sells:

Canadian National – TCI disclosed the sale of nearly 7 million shares of the railroad company between September 18th and October 18th, reducing their stake to 7.2% of shares outstanding.

Ses FA – Pertento disclosed a new short position in the French satellite company on November 5th

Kokuyo – On November 1st, Oasis disclosed a new 5% stake in the Japanese office supply company.

Impinj - Sylebra sold ~$86 million of stock in the cloud connectivity company between November 5-7th.

Other News & Events:

Article on Baylor’s iterative approach to portfolio management.

Pinestone co-founder indicted for trade secret theft.

Nokia of America hires Mercer to oversee $13 billion pension.

University of Rochester returned 9.5% for FY24.

Vanderbilt returned 9.2% for FY24.

Michigan State is hiring a Director of Investments.

Alfred Sloan Foundation is hiring a Senior Investment Professional.

Please reach out anytime with questions, comments, suggestions, or ideas!

-The OWL Team

About Old Well Labs (OWL)

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Please feel free to selectively share these updates with high-quality allocators who might be interested in learning more about the system.

Reach out to learn how OWL can help you find, monitor, and connect with fund managers globally