8.1.23

Dear OWL Users,

After the quick July performance recap below, we dive into biotech managers and the various ways that OWL users can track them in the OWL system.

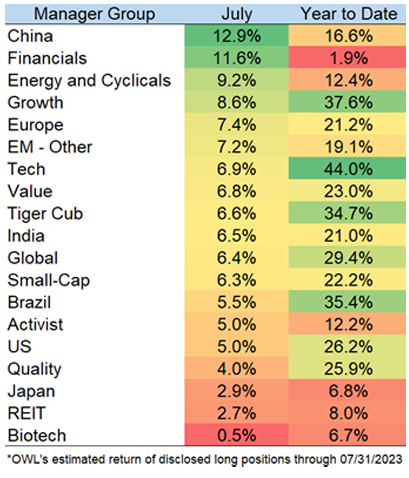

July Performance Update

Most of the long portfolios tracked in OWL gained during July. Some of the best returns came in China (Coreview +21%, Cederberg +18%), while managers with large Carvana positions again performed well (Spruce House +31%, CAS +25%). VC Funds who hold public positions in companies like Coinbase, Doordash, Airbnb, and Robinhood also saw large gains (a16z , Ribbit, Founders Fund, Index Ventures, etc.)

Biotech managers were at the bottom in July, driven by stock-specific moves that caused managers such as Octagon (-20%), EcoR1 (-11%), Avoro (-8%), and Orbimed (-4%) to have losses. As a reminder, all performance numbers are estimates of each manager’s publicly disclosed long positions and are updated daily on the OWL Platform .

While longs gained during July, it was a difficult month for short-sellers. Goldman’s Prime Brokerage shared yesterday that “Prior to Friday (7/28), Fundamental L/S managers had experienced 9 consecutive days of negative alpha returns, the longest streak since Jan 2017 based on our estimates…mainly driven by a sharp degradation in short side alpha.”

Biotech Deep Dive

Biotech is one of our favorite US sectors for tracking ownership disclosures. Stocks are volatile, there are dozens of specialist managers with impressive long-term track records, and their activities can often be tracked via timely disclosures such as 13Ds, 13Gs, and Form 4s.

Biotech managers have also been a major contributor to endowment performance in recent decades. Retired Princeton CIO Andy Golden noted in a 2017 podcast that 40% of the University’s domestic equity portfolio was invested in a single biotech manager (we believe Baker Brothers due to historical filings):

“Within domestic equity, we’ve got 40% of that 10% with just one manager…these guys, who many of our closest friends invest with them, do biotech stocks”

(source: Capital Allocators interview with Andy Golden )

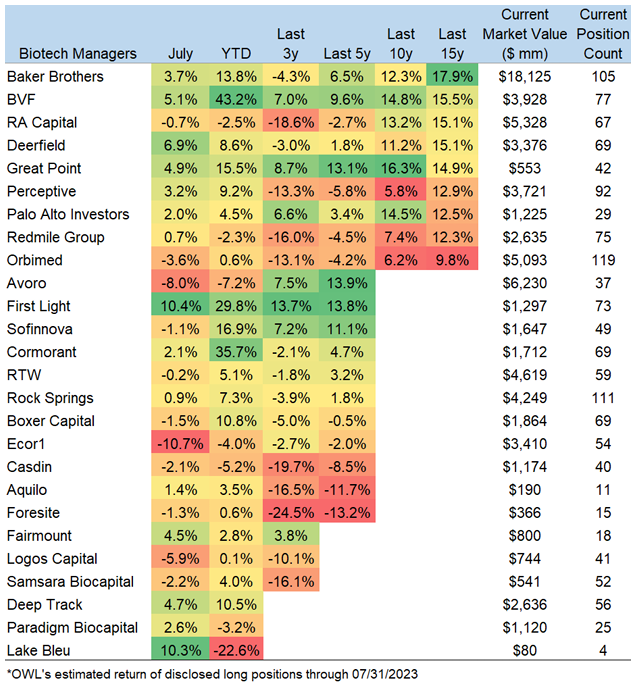

Below is a table with OWL’s estimated returns for a selection of well-known biotech managers. A larger list, updated daily, can be tracked on OWL’s biotech group page . Let us know if we are missing any good ones!

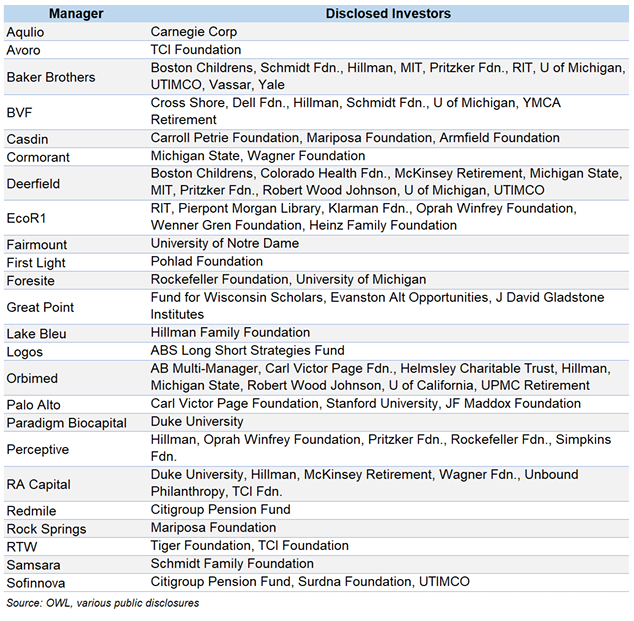

Biotech managers have been popular among the allocator community. The table below shows a selection of publicly disclosed LPs for each manager. OWL’s allocator database now tracks almost 1,500 allocators; users can see the latest information and disclosures in OWL's allocators section .

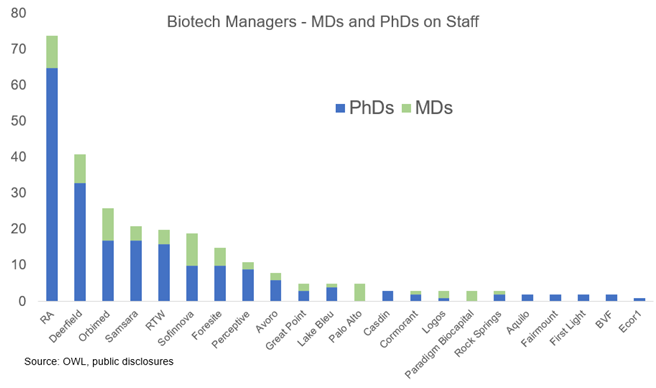

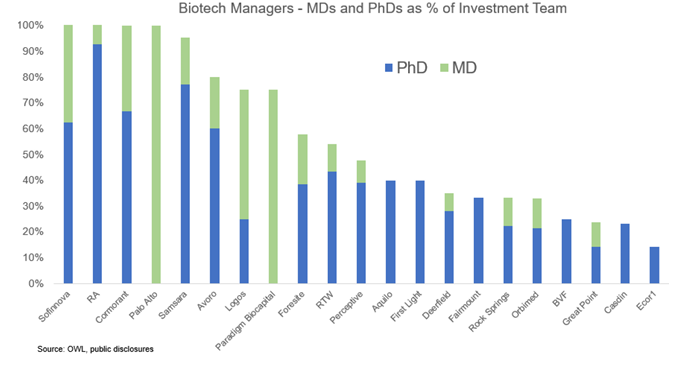

A significant focus for the OWL data and engineering team is improving the quality of our people data and analysis - we have several exciting updates coming in the next few months. In the table below, we utilize our people data to analyze how many PhDs or MDs are on the staff of each biotech manager.

We can also calculate the #’s above as a percentage of each investment team:

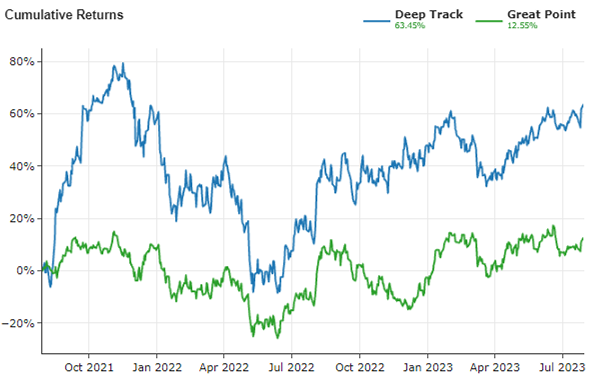

OWL’s people data can also be used to track spinouts and new launches. One example in biotech is David Kroin, who launched Deep Track Capital in 2020 after serving as Managing Director at Great Point Partners. Deep Track’s disclosed positions since launch have significantly outperformed Great Point’s, which you can see below. Custom charts like this can be easily created using OWL’s reports builder found on each manager page.

While all returns shown in OWL are estimates, and sometimes there are meaningful lags in the timeliness of disclosures, in biotech, OWL captures a large number of timely filings from sources such as 13Ds, Form 4s, and 13Gs, which are common in the sector.

One recent example is EcoR1’s position in Apellis Pharma. The company gained approval earlier this year for Syfovre, a drug that treats an eye disease called geographic atrophy. In mid-July, the American Society of Retina Specialists reported that six recipients of the new drug experienced inflammation in their eyes, causing the stock to quickly fall by more than half on July 17th and 18th. EcoR1, which previously owned 4.7% of Apellis, quickly disclosed that it bought more shares of Apellis on the 18th in a filing that came out that same day.

Please reach out anytime with questions, comments, suggestions, or ideas!

-The OWL Team

About Old Well Labs (OWL)

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Please feel free to selectively share these updates with high-quality allocators who might be interested in learning more about the system.

Reach out to learn how OWL can help you find, monitor, and connect with fund managers globally