10.18.24

Dear OWL Users,

This week, we offer a first look at FY24 endowment performance as many universities have recently shared their results. While some schools haven’t reported yet, OWL users can track the latest numbers as they come in using OWL’s Endowment Performance tool.

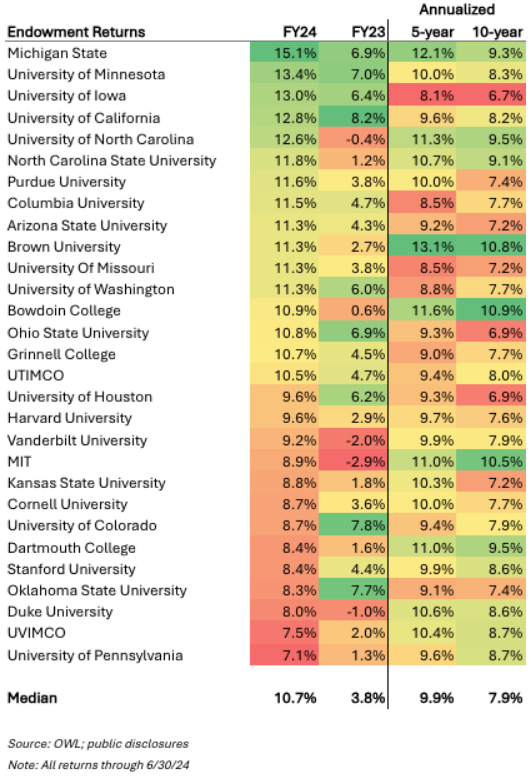

The table below shows returns for the schools that have reported FY24 numbers so far. Several big names, including Yale, WashU, Princeton, and Notre Dame, haven’t weighed in yet, but are likely to be near the top in terms of long-term performance.

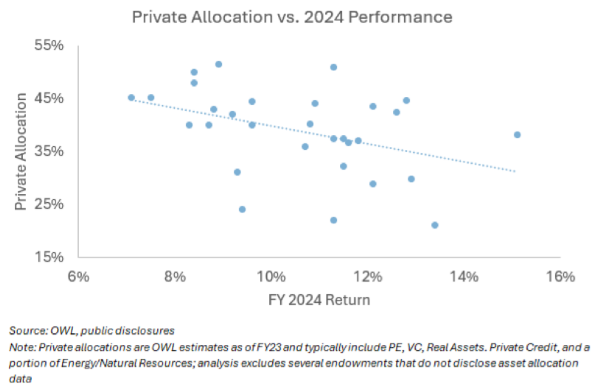

Similar to last year, FY24 performance was uncorrelated with longer-term results, with overall private exposure a significant factor. Yesterday’s WSJ article discussed some of the same trends, as CIOs noted the drag of venture capital write-downs.

Given the strong performance in public markets over this period (S&P +25%; ACWI +20%), it’s no surprise that endowments with more exposure to public equity outperformed. Michigan State, the best performing endowment for FY24 thus far, is a good example of this, with nearly 40% of their endowment invested in global equities, with most of that in passive and index-like exposure. OWL users can see Michigan State’s entire portfolio here.

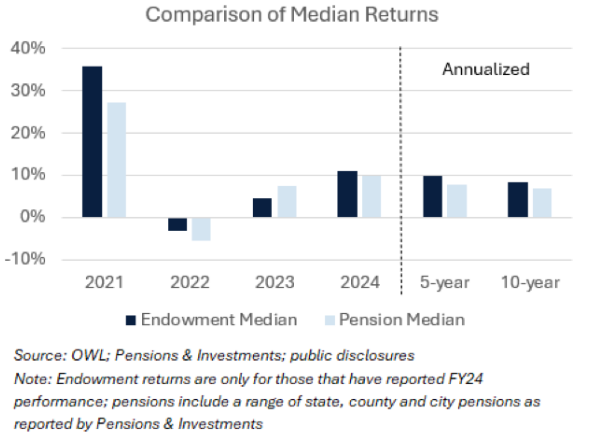

It looks like endowments will once again outperform pensions for FY24, after a rare year in FY23 when the median pension outperformed the median endowment:

Recent Buys / Sells:

Teleperformance - Jericho added to its short position in the French telemarketing company on October 10th and 15th.

Yellow Hat - Strategic Capital increased its stake in the Japanese software company on October 4th to over 11% of shares outstanding, making Yellow Hat the firm’s largest position.

Eneva - Atmos disclosed a sale in the Brazilian power company on October 15th, bringing their ownership stake below the 5% filing threshold.

IIFL - Theleme disclosed a new 1.5% stake in the Indian financial services company as of September 30th.

Other News & Events:

FT piece on the OCIO market

GEM’s recent perspective on the endowment model

Capital Allocators podcast with Rahul Moodgal

Podcast with the University of Rochester endowment

Podcast with the University of Illinois CIO

CalTech is hiring a CIO

Getty Museum is hiring a Director of Investments

UVIMCO is hiring a Managing Director, Public Equity

Please reach out anytime with questions, comments, suggestions, or ideas!

-The OWL Team

About Old Well Labs (OWL)

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Please feel free to selectively share these updates with high-quality allocators who might be interested in learning more about the system.

Reach out to learn how OWL can help you find, monitor, and connect with fund managers globally