2.23.24

Dear OWL Users,

Mid-February is always an exciting time at OWL HQ, as hundreds of managers disclose positions for the first time via new 13F filings. While the OWL system collects ownership disclosures from dozens of global sources, for US-listed stocks, 13Fs remain the largest data source.

This year, over 440 investors released a 13F for the first time. In recent days, we’ve looked through all of those, and below, we highlight the group of 30 that we found the most interesting.

The managers have a variety of locations and areas of focus - in general, we tried to find groups who previously worked at well- regarded firms and appear to have relatively concentrated portfolios. Some are recent launches, while others are established managers who filed a 13F for the first time or started again after a long pause. As always, these aren’t investment recommendations, but let us know any feedback or if we're missing any interesting ones!

One note - the links on the manager names will take OWL users to their page in the OWL system, while the links for “key person” go to their LinkedIn page.

30 New 13F Filers:

- 8 Knots

- Location: New York

- Key Person: Scott Green

- AUM: $260 million

- Top Holdings: DVA, EHC, CI

- Note: ex-Orbimed

- Altitude Crest

- Location: Stamford, CT

- Key Person: N/A

- AUM: $222 million

- Top Holdings: LEGN, BBIO, DHR

- Note: affiliated and controlled by Hillhouse Capital

- Aragon Global

- Location: Miami

- Key Person: Anne Dias

- AUM: $318 million

- Top Holdings: QQQ, MSFT, SMH

- Note: launched in 2001, first 13F since 2010, ex-Viking

- Arvin Capital

- Location: Austin, TX

- Key Person: Rohan Varavadekar

- AUM: $533 million

- Top Holdings: LW, AVTR, NTNX

- Note: ex-Nokota

- Breach Inlet Capital

- Location: Mt Pleasant, SC

- Key Person: Chris Colvin

- AUM: $109 million

- Top Holdings: BATRK, TIPT, HGV

- Note: small-cap equities, some activism

- Cable Car Capital

- Location: San Francisco

- Key Person: Jacob Ma-Weaver

- AUM: $207 million

- Top Holdings: ATCH, EMLD, PANL

- Note: Small-cap value

- Candelo Capital

- Location: New York

- Key Person: John McMonagle

- AUM: $118 million

- Top Holdings: ESI, CRH, BLDR

- Note: ex-Glenview

- Checkpoint Capital

- Location: San Francisco

- Key Person: Sam Huang

- AUM: $157 million

- Top Holdings: RYTM, ARGX, CYTK

- Note: biotech, ex-BVF, 2023 launch

- Delta Global Management

- Location: New York

- Key Person: Andrew Komery

- AUM: $579 million

- Top Holdings: AMZN, MSFT, STM

- Note: 2023 launch, ex-DE Shaw

- Estuary Capital

- Location: Wayzata, MN

- Key Person: Alex Walker

- AUM: $237 million

- Top Holdings: DG, JAZZ, CPNG

- Note: ex-Hudson Way, long/short equity

- Findell Capital Management

- Location: New York

- Key Person: Brian Finn

- AUM: $144 million

- Top Holdings:

- Note: ex-MAK, 2019 launch

- Fourth Sail Capital

- Location: Sau Paulo

- Key Person: Ari Merenstein

- AUM: $1.2 billion

- Top Holdings: MTAL, ARCO, BPOP

- Note: Latin America long/short, ex-Prince Street

- Gate City Capital

- Location: Chicago

- Key Person: Michael Melby

- AUM: $143 million

- Top Holdings: ALCO, MCS, STRT

- Note: Micro-cap value equity

- Grafton Street Partners

- Location: North Palm Beach, FL

- Key Person: Scott Malpass

- AUM: $509 million

- Top Holdings: GOOGL, FNF, TPG

- Note: former Notre Dame CIO, co-founders from H.I.G. and Tiger Global

- GrizzlyRock Capital

- Location: Chicago

- Key Person: Kyle Mowery

- AUM: $175 million

- Top Holdings: OEC, GSM, GPRE

- Note: 2012 launch, first 13F

- Incentive AS

- Location: Oslo

- Key Person: Svein Hogset

- AUM: $2.2 billion

- Top Holdings: NE

- Note: Europe equities, first 13F. backed by Duke, Boston Children’s, etc.

- LB Partners

- Location: Charlottesville, VA

- Key Person: Chas Cocke

- AUM: $134 million

- Top Holdings:

- Note: ex-Investure

- Linonia Partnership

- Location: New York

- Key Person: Philip Uhde

- AUM: $823 million

- Top Holdings: GWRE, VEEV, TPX

- Note: ex-Echinus, SPO

- Maren Capital

- Location: Chicago

- Key Person: Brad Schatz

- AUM: $162 million

- Top Holdings: TDY, RBC, RLI

- Note: Value equity, backed by Blackstone

- Monolith Management

- Location: Hong Kong

- Key Person: Timothy Wang

- AUM: $479 million

- Top Holdings: PDD, MSFT, NTES

- Note: ex-Boyu, MIT is invested

- Pennant Select

- Location: Summit, NJ

- Key Person: Alan Fournier

- AUM: $105 million

- Top Holdings: SATS, GOOGL, AMZN

- Note: First 13F since returning client capital in 2018

- Scalar Gauge

- Location: Dallas

- Key Person: Sumit Gautam

- AUM: $134 million

- Top Holdings: ALKT, ZUO, CTAS

- Note: ex-Hirzel Capital

- Sea Cliff Partners

- Location: San Francisco

- Key Person: John Hockin

- AUM: $256 million

- Top Holdings: ACHC, UDMY, COTY

- Note: concentrated public equity, ex-KKR

- Stempoint Capital

- Location: New York

- Key Person: Michelle Ross

- AUM: $264 million

- Top Holdings: ROIC, SNDX, ACLX

- Note: Biotech long/short, backed by Leucadia

- Superstring

- Location: New York

- Key Person: Ting Guo

- AUM: $429 million

- Top Holdings: IMGN, CYTK, ETNB

- Note: ex-Teng Yue, China biotech

- Surgocap

- Location: New York

- Key Person: Mala Gaonkar

- AUM: $2.0 billion

- Top Holdings: MSFT, MCK, LPLA

- Note: ex-Lone Pine

- Tyro Capital

- Location: New York

- Key Person: Dan McMurtie

- AUM: $150 million

- Top Holdings: CCOI, SHC, ROIV

- Note: SuperMugatu on fintwit, seeded by Greenlight Masters

- Vestal Point

- Location: New York

- Key Person: Ryan Wilder

- AUM: $1.3 billion

- Top Holdings: NBIX, JAZZ, ASND

- Note: 2023 launch, ex-Point72 healthcare PM

- Vision One Management

- Location: Miami

- Key Person: Courtney Mather

- AUM: $129 million

- Top Holdings: TGI, CZR, KSS

- Note: 2022 launch, ex-Icahn

- Walnut Level Capital

- Location: Denver, CO

- Key Person: Charlie Antrim

- AUM: $105 million

- Top Holdings: INGR, APD, MEOH

- Note: ex-SAC, supply chain and ag-focused, backed by Borealis

Product Updates

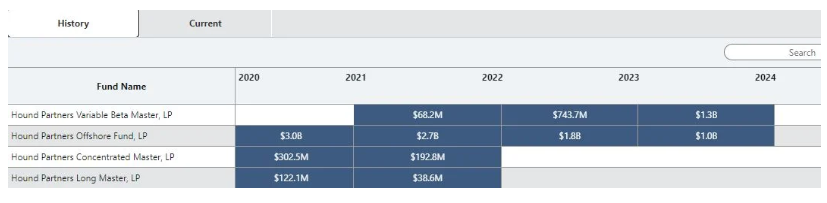

Today, we rolled out fund-level details to the manager pages in OWL based on data reported by managers in their Form ADVs. On the main manager dashboard , there is now a "Funds Managed" summary, and on the “Funds” view for any manager, you can see full details, including a visual of how a manager’s vehicles have changed over time.

For example, in the table below, you can see that Hound Partners closed two vehicles in 2021 and has significantly grown the "Hound Partners Variable Beta Master" fund in recent years.

We also added a table to the dashboard where users can quickly see the most and least correlated managers to the manager in question based on OWL’s return estimates. Below is an example, again for Hound Partners:

We’re excited about the product roadmap ahead for OWL – please keep your feedback and ideas coming!

Recent Buys/Sells

Maplebear (Instacart) – Sequoia bought shares on the open market between Feb 20-22nd.

America’s Carmart – Magnolia Capital added to its position on Feb 16th and Feb 20th.

Universal Technical Institute – Coliseum Capital sold shares on Feb 15th.

Fujistu – Ichigo trimmed its position on Feb 5th, decreasing the fund’s stake from 7.1% to 6%.

IndiaMart - Arisaig sold shares in the Indian B2B marketplace on Feb 15th, decreasing its stake to 2.99% of the company. The fund owned 6% of the company at the end of Q3 but decreased its stake to 3.2% during Q4.

Please reach out anytime with questions, comments, suggestions, or ideas!

-The OWL Team

About Old Well Labs (OWL)

OWL is an intelligence platform built for allocators, by allocators. Leading endowments, foundations, and family offices use the system to find, monitor, and connect with thousands of fund managers globally. OWL's analytics engine has collected over one billion data points from 65 countries. We make it easy for allocators to find and track information about the managers they care about – not just positions but also performance analytics, people data, business information, and details about the manager investments of other allocators.

Please feel free to selectively share these updates with high-quality allocators who might be interested in learning more about the system.

Reach out to learn how OWL can help you find, monitor, and connect with fund managers globally